Budgeting App Essentials You Must Integrate To Skyrocket Your App Downloads

“Growth at all costs“ is not something people believe in nowadays. The rules of the finance game have changed, making financial wellness as important as basic life and mental health.

With this notion carved into mind, people are falling back on the fintech industry to make their spending decisions and manage their money. This spending behavior has led to unprecedented growth of Fintech apps. A survey by Google reports that an average smartphone user has a minimum of 2.5 finance apps installed in their phones.

Personal finance apps have taken the lead in the fintech sector. Fact.MR reports that the worldwide revenue from personal finance apps is projected to increase at a CAGR of 15.8% and reach US$ 12.58 Billion by the end of 2034. Meaning, these apps are becoming indispensable for managing lifestyle.

Amidst the bustle of exotic features and exaggerated promises, what makes a budgeting app stand out? Its user-friendliness. We have compiled a list of features that make a budgeting app user-friendly, seamless and craft experiences that people love.

We have also compiled the best practices to follow when you are building a Fintech product. It includes case studies on how we tackled some design challenges. Click here to read it.

Must Have User-Friendly Features For A Budgeting App

To stand out from the millions of other finance apps, you need to provide unique value to your users. These features will make sure you stand out.

Seamless Account Integration: Cutting Out Human Errors

Manual entry of transactions is something we all feel like avoiding, it is a major pain point that users have. It is time consuming and often leads to errors and decreases engagement.

Seamless account integration feature takes this pain away by effortlessly connecting multiple bank accounts, credit cards, and other financial institutions directly to the app. This eliminates the need for manual data entry. This not only saves users valuable time but also ensures that their financial data is accurate and up-to-date.

Learn more about multiple account integration and how to ensure safety for your users. Read more about it here

Intuitive Expense Categorization: Taming Financial Chaos

![]()

Compartmentalizing the expenses into intuitive categories makes it easy for the user. The step of sorting the transactions in real-time is made easy with pre-existing categories. This also avoids creating a new bucket every time they make a new transaction. However, to truly provide value, your app should go beyond basic categorization.

Key elements of intuitive expense categorization:

- Comprehensive category list

- Customizable categories

- Smart suggestions

- Hierarchical categorization: For example, the “Dining Out” category could have subcategories like “Fast Food,” “Restaurants,” and “Bars.”

Real-Time Budget Monitoring: Keeping Finances In Check

Real-time monitoring of finances is a must have of a budgeting app for it to be good and stand out of the crowd. Only when users constantly assess their financial progress, can they make informed decisions of what’s next. Having this feature gives your user a clear and up-to-date view of financial health.

The real-time monitoring feature must have a dynamic overview of the spends, income, and savings or investments.

See how our real-time budget monitoring powers the biggest player in the fintech industry. Click here.

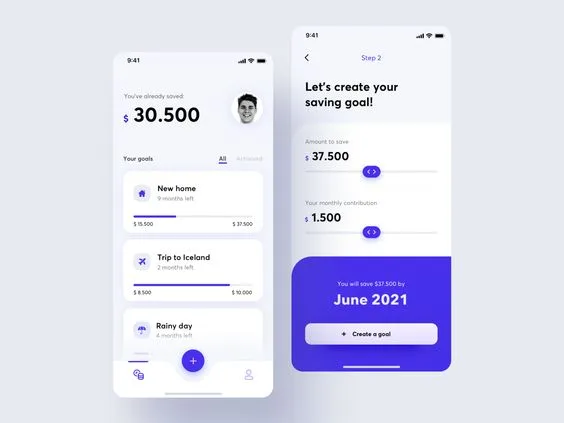

Goal Setting and Tracking: First Step to Financial Success

A budgeting app is ultimately a tool for achieving the users’ financial goals. To go there, a transaction tracker is important. Goal setting and tracking are essential components of a successful budgeting app.

Enabling inclusions like defining their personal financial aspirations, whether it’s saving for a down payment or a vacation or retirement, you empower them to take control of their financial future.

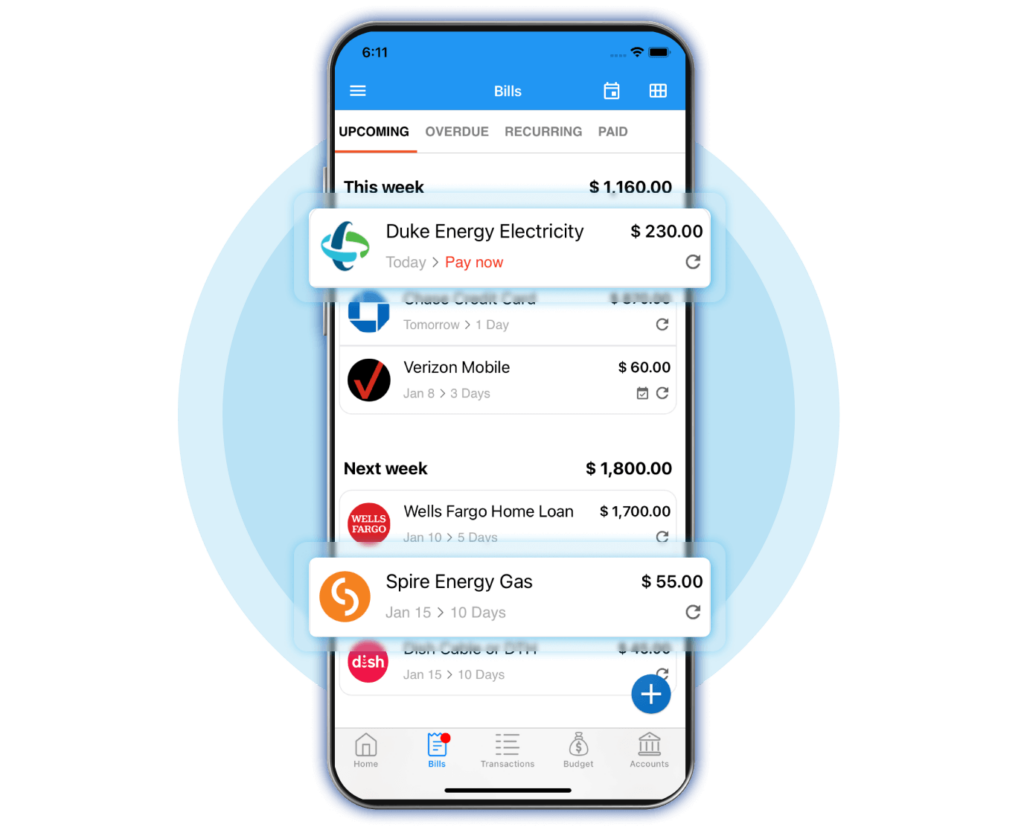

Bill Pay Reminders: Financial Safety Net

Late fees and damaged credit scores are the unwelcome consequences of missed bill payments. A budgeting app that doesn’t help users stay on top of their bills is missing a crucial feature. Bill pay reminders are essential for preventing financial stress.

This aspect can be implemented by offering various elements and actions such as:

- Automated bill tracking

- Customizable reminders

- Scheduled transfers

- Bill categorization

- Payment history

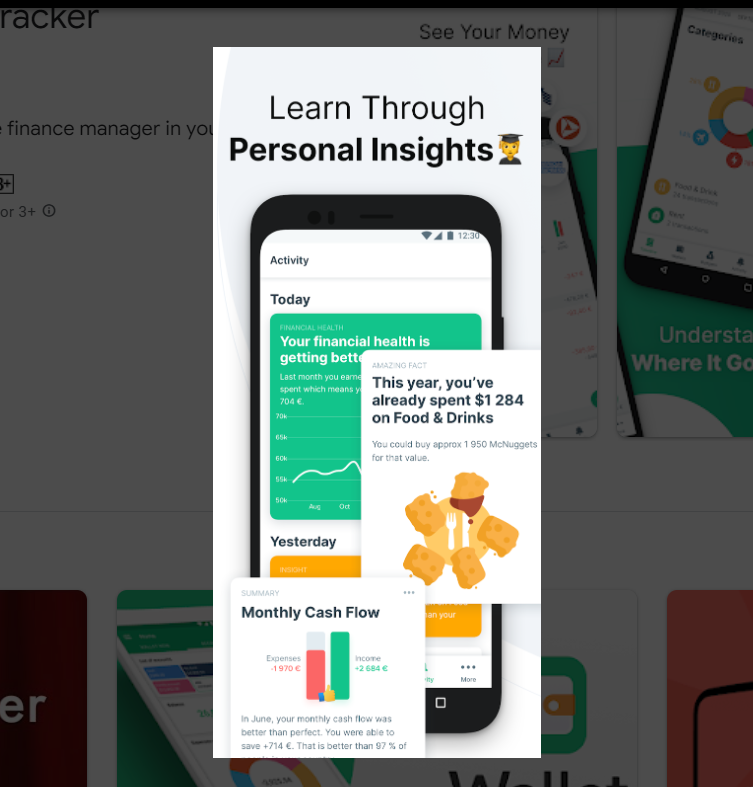

Insights and Analytics: Unlocking Financial Wisdom

For a budgeting app to be robust, it must go beyond simple transaction tracking and empower its customers with actionable insights.

Adding insights and analytics features to the app gives the customer the power to make the decisions. But, the data or insights should be delivered through visually appealing summaries,

easily-identifiable spending trends, and offering personalized reports. These visualization techniques help users develop loyalty to the app as well. Predictive analytics can be integrated to forecast future spending, while benchmarking tools offer valuable comparisons.

An added feature that can act as an enticer is by aligning spending data with user-defined goals. An anomaly detection element also ensures safety against fraudulent activity, verifying financial security.

Supercharge Your UX Design With Us

Creating a visually appealing and intuitive interface is the most critical way to achieve success for your budgeting app. While pre-built templates can provide a solid foundation, the true magic lies in crafting a unique and engaging user experience.

Modern budgeting apps demand more than just basic UI elements. Interactive features like AI chatbots, notifications, and in-app messaging are becoming standard expectations. These elements require careful consideration and continuous iteration to evolving user preferences and technological advancements.

At NetBramha, we specialize in crafting exceptional fintech experiences. Our iterative design process ensures that your app is not only visually stunning but also highly functional and user-centric. We identify and address potential challenges early in the design phase and streamline the development process, delivering a product that exceeds expectations.

Let us help you create a budgeting app that not only looks great but also delights your users.

Contact us today to learn more about our fintech design services.