Domain

Fintech & Digital Payments

Platform

Mobile App

Geography

India

Services

Research, Strategy, Design

The redesign that was both beautiful & functional.

BHIM (Bharat Interface for Money) is India’s official UPI-based mobile payment application, enabling instant & secure bank-to-bank transfers. Introduced to promote financial inclusion & accelerate the country’s move toward cashless payments, BHIM is a product built for every Indian – from daily wage earners in Tier 3 towns to professionals in metro cities. However, despite being a government-backed platform, BHIM struggled to compete with private players like Google Pay, PhonePe & Paytm in terms of adoption, engagement & user experience.

NetBramha partnered with BHIM to reimagine the product experience – transforming it from a purely functional government app into a seamless, engaging & inclusive digital payment companion for the next billion users.

Challenge

Despite its credibility & reach, BHIM faced a steep challenge in both perception & performance. While private apps dominated the UPI ecosystem, BHIM’s interface felt outdated & uninspiring. Users perceived it as a basic, no-frills government service lacking the polish & ease of use offered by competitors. Existing users also showed low engagement – returning only for essential transactions.

The design lacked engagement hooks, emotional connection & clear navigation, resulting in poor retention, cluttered flows & a fragmented experience. These challenges shaped our design direction – to build trust, engagement & accessibility through simplicity.

Solution

NetBramha’s approach was rooted in a Simplicity-first Design Strategy, ensuring every interaction was intuitive, quick & inclusive. We focused on reducing friction in core payment journeys, while introducing features that inspired habitual engagement & emotional connection.

By integrating interactive, everyday-use features such as Family Mode, Spend Analytics & UPI Circle, the redesigned BHIM went beyond being a transactional app to becoming a financial ecosystem for every Indian. The outcome was a seamless, accessible & human-centered product experience designed for inclusivity & scalability.

Research

Our discovery phase involved extensive qualitative & quantitative studies to understand both BHIM’s users & non-users. Surveys, interviews & heuristic evaluations helped us uncover how perceptions, usability challenges & trust issues affected adoption.

We conducted a detailed competitive analysis of other UPI players – Google Pay, PhonePe, Paytm & Cred – to understand how emotional design & micro-interactions influenced loyalty & engagement. These insights informed our roadmap to rebuild BHIM’s user experience around clarity, trust & inclusivity.

Pain points discovered

Perceived

Government App

Low connection & trust compared to private alternatives

Cluttered Interface

Confusing layouts & poor visual hierarchy hindered completion

Limited

Repeat Usage

Users had no motivation to return beyond basic money transfers

Inconsistent Accessibility

Lack of language & contrast support excluded low-literacy & regional users

Strategy

Our strategy focused on making BHIM more than just a payment tool – it needed to become a trusted daily companion for financial actions. We used a Simplicity-first framework centered around three pillars.

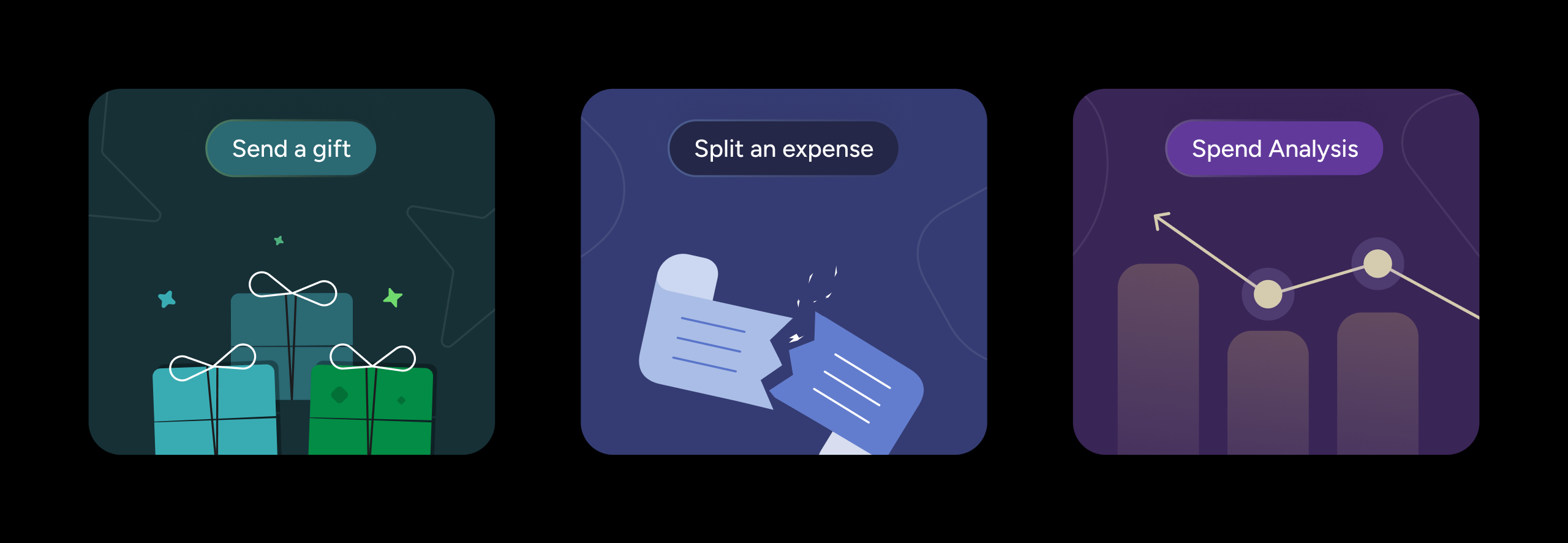

First, Clarity & Ease of Use, achieved by streamlining navigation & surfacing key actions like ‘Scan & Pay’ within thumb reach. Second, Engagement-driven Features, which turned one-time transactions into ongoing relationships through interactive elements like Gifting, UPI Circle & Spend Analytics. Third, Localized & Inclusive Design, supporting all Indian languages & accessibility standards (WCAG) to ensure equitable usability.

Through this framework, BHIM evolved from a transactional platform into a human-centered digital payment ecosystem.

Simplified Payments

Streamlined Scan & Pay, UPI Lite & transaction flows for fast & frictionless payments

Enhanced Engagement

Introduced UPI Circle, Spend Tags & Gifting to increase daily interactions & repeat usage

Inclusive Design

Supported all Indian languages with visuals & accessible components for all users

Design

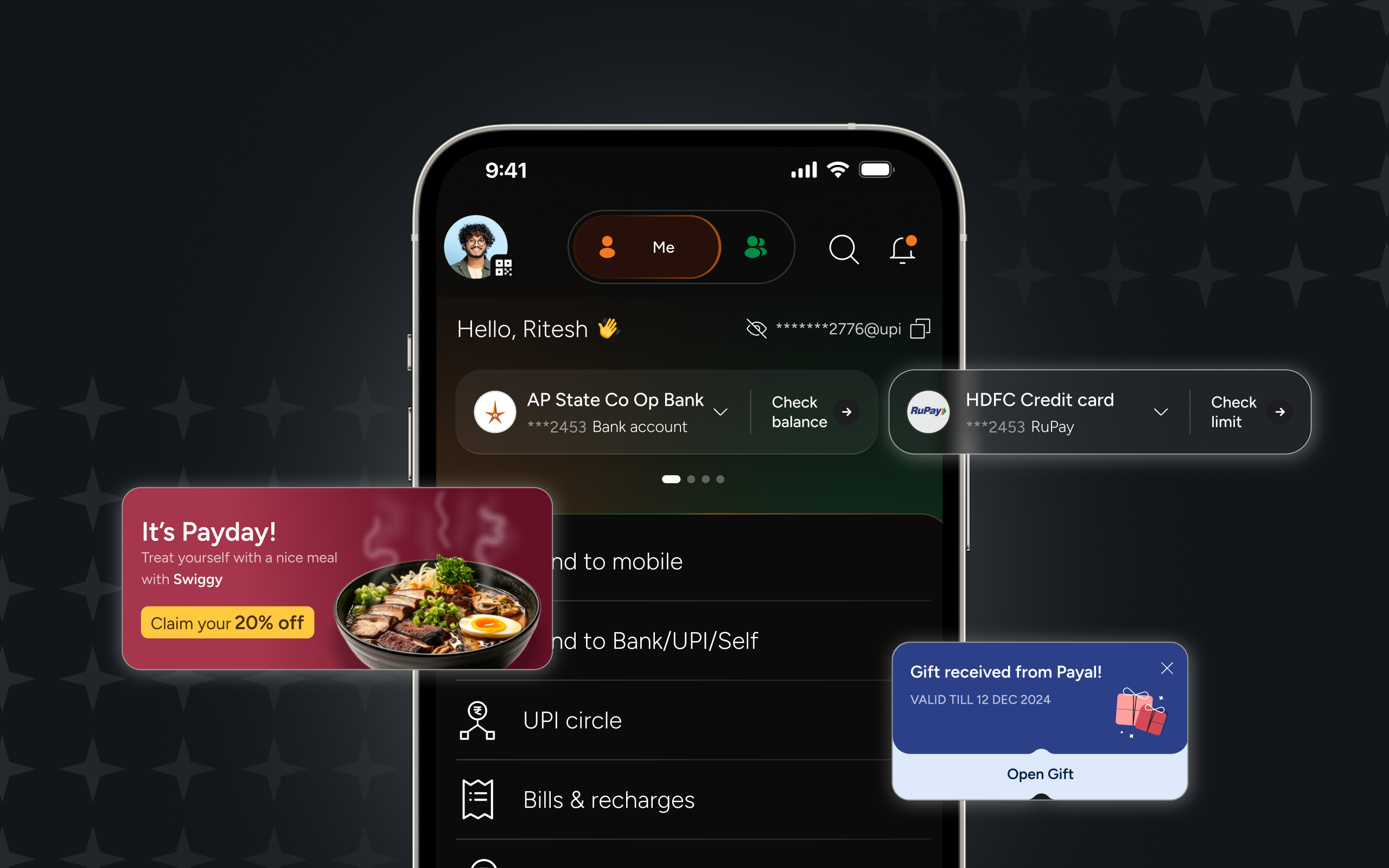

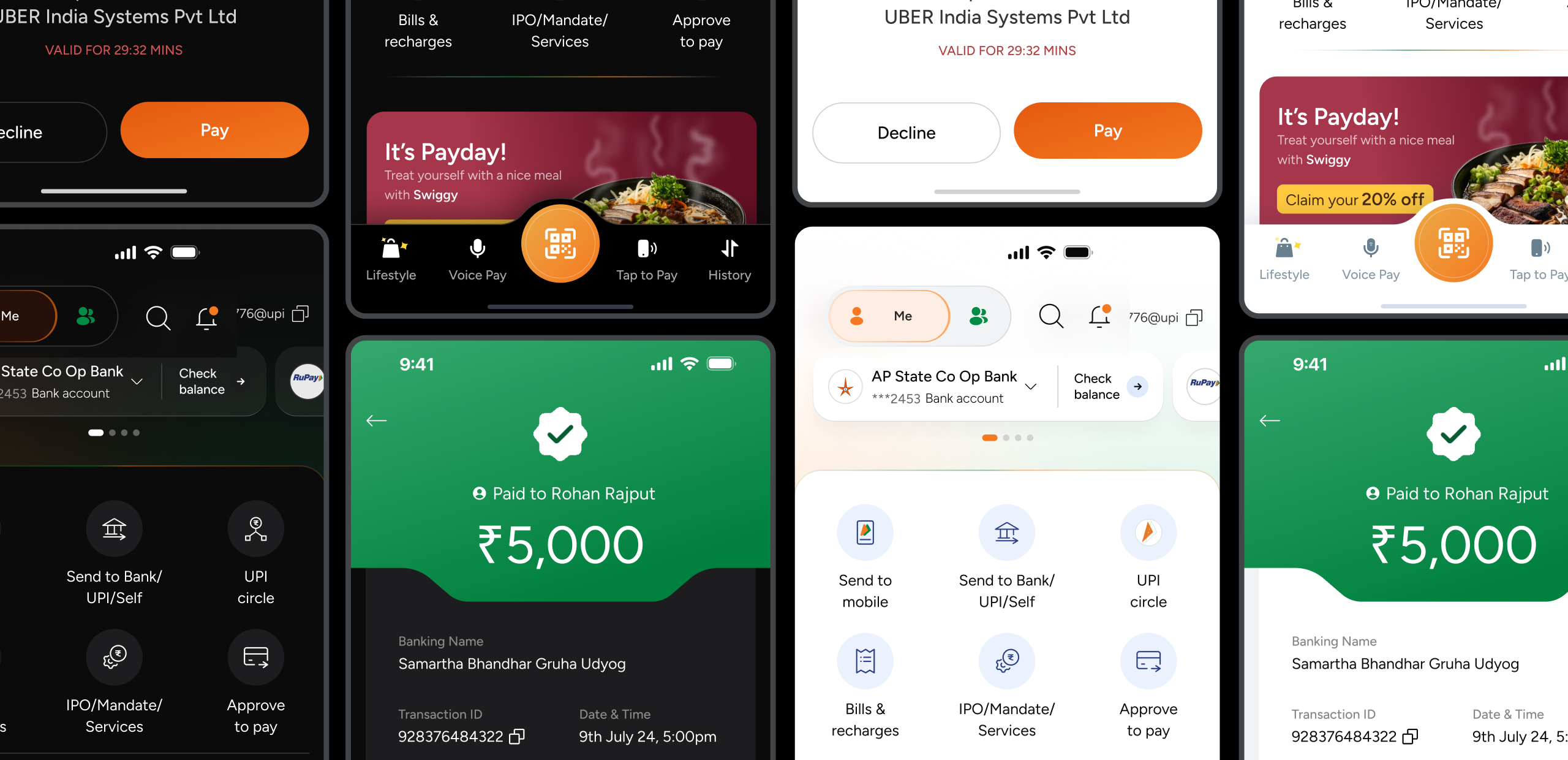

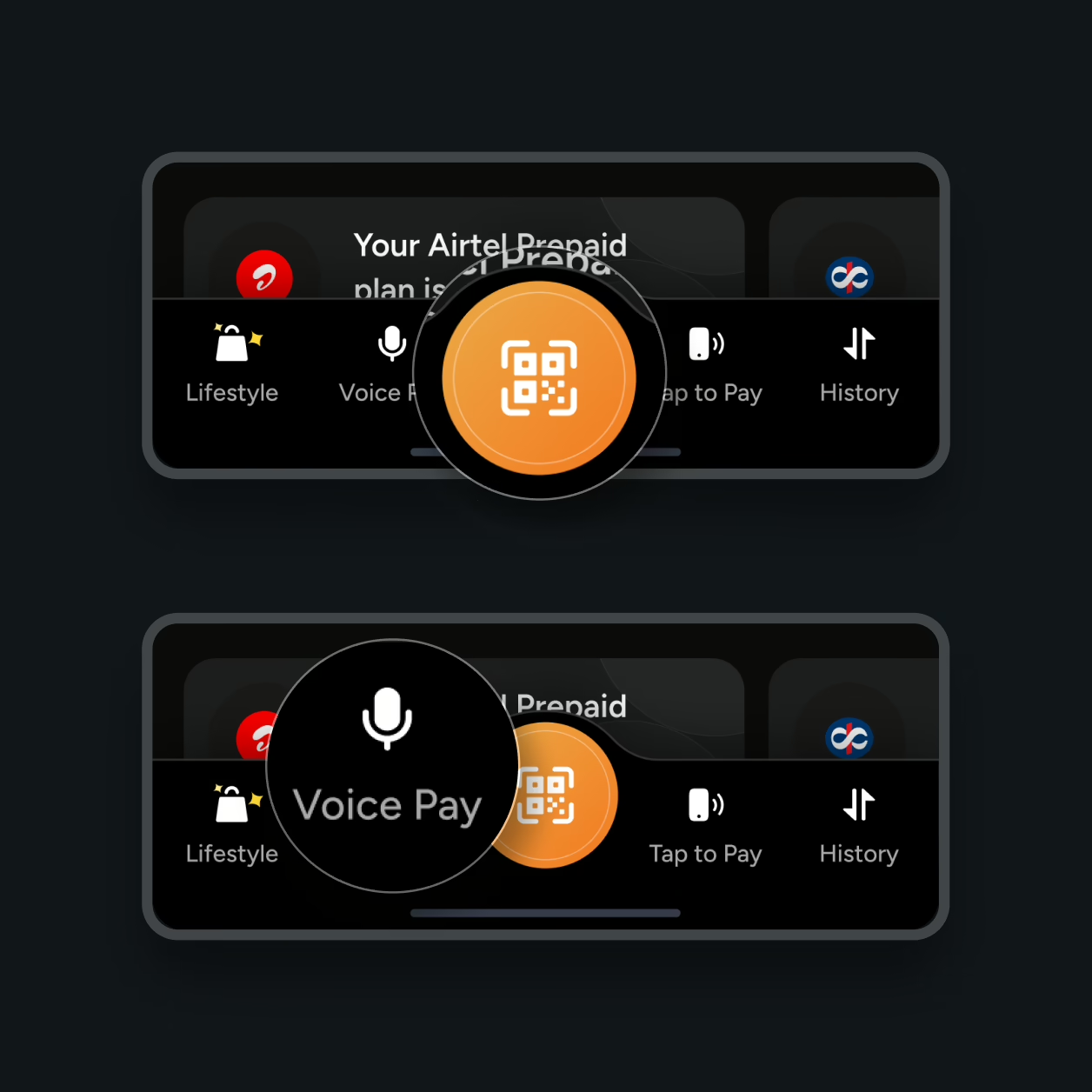

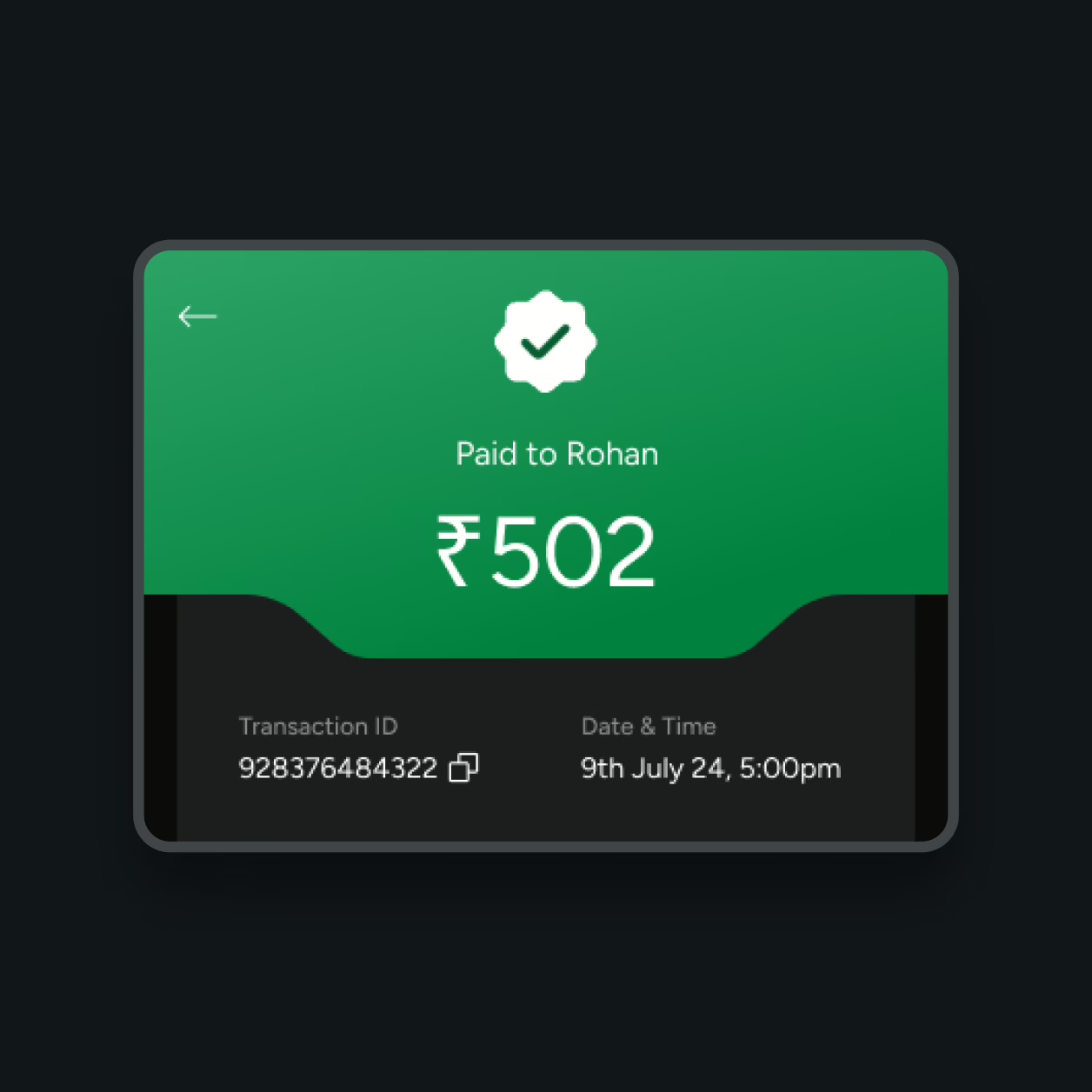

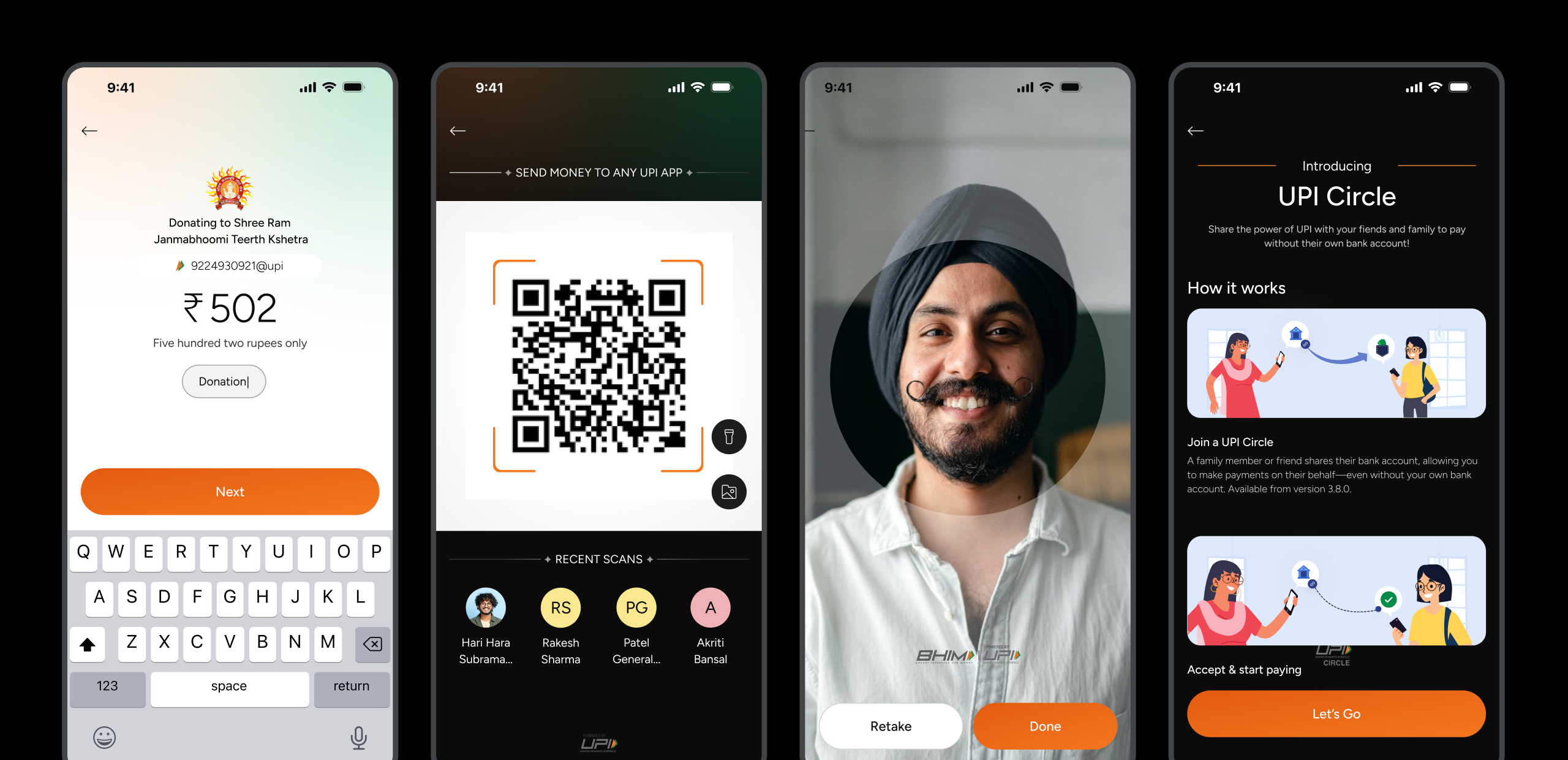

We redesigned the Scan & Pay experience to be faster & more intuitive by reducing steps to just two & positioning controls for ergonomic use. We introduced options like Pay with Voice, Tap & Pay for faster transactions & greater flexibility.

The Transaction History section was restructured to improve visibility, search & filtering. Categorized views, merchant tagging & exportable statements made record-keeping easier for small business owners & frequent users.

Through UPI Lite, we enabled small-value, PINless transactions for everyday needs like groceries & cabs, optimizing performance even during network congestion.

Spend Tags empowered users to track & manage budgets with predefined & custom categories, providing visual insights into monthly spending patterns.

We also designed UPI Circle, an innovative feature allowing families or groups to share account access securely, with permissions & limits for each member, encouraging collaborative financial management.

Finally, we built a comprehensive Design System that unified BHIM’s look & feel across all screens. This scalable system standardized colors, typography & components, ensuring accessibility, consistency & faster feature rollouts.

Visual design

We went through multiple design iterations to create a visual language that reflects BHIM’s simplicity, trust & modernity. A refined color palette & thoughtful contrasts enhanced clarity & accessibility. Custom icons, clean typography & purposeful imagery together shaped a seamless, contemporary experience that feels both distinctly Indian & globally relevant.

Outcome

The redesigned BHIM UPI App transformed user perception – from a “government utility” to a modern, people-first platform built on trust & inclusivity. Engagement-driven features encouraged repeat usage & improved retention rates. Accessibility & localization extended BHIM’s reach to users across India’s linguistic & economic spectrum, while the robust design system ensured long-term scalability & consistency.

The result was an app that didn’t just enable transactions but fostered confidence, connection & everyday simplicity – a benchmark for inclusive fintech experiences at scale.

The app has seen transactions triple in 2025, moving from 38.9 million to nearly 120 million monthly transactions.