10 Complex Fintech Challenges And How We Solved Them With Design

Many amazing fintech apps, powered by even better technology, fail to achieve any success for their company. This sounds shocking, but it is commonplace for many fintech players. A recent study showed that almost 73% of people would switch banks to get a better digital experience. This shows that user experience has a significantly growing importance in fintech. It is also the reason why so many fintech startups collapse as fast they are formed. They get bogged down by clunky interfaces, elaborate onboarding, and a labyrinth of regulations. This leads to countless confused users and stunted growth.

But it’s not game over for these companies. With expert design, these challenges become opportunities. We’ve witnessed it firsthand, empowering fintech firms not just to endure, but to flourish. We don’t merely solve UX problems – we engineer intuitive, user-friendly experiences that drive exponential growth.

Reimagining Corporate Debt Management through Intuitive Design for Yubi

-

- Region: India

-

- Target Demography: B2B/B2C companies

Managing corporate or business debts is complex, fragmented, and lacks a comprehensive, centralized solution. Businesses regularly manage debts, securitization, and other financial processes but face significant challenges navigating the chaotic landscape.

Yubi partnered with NetBramha to develop a one-stop debt management platform tailored to diverse business needs. Names the world’s first possibility platform, it powers the discovery, investment, and fulfillment of credit lines for businesses. It offers personalized solutions to over 17,000 enterprises and 6,200 investors, facilitating more than ₹14,000 crores in credit.

Backed by deep research, we created a web application and website that consolidated various debt management solutions, including corporate loans, supply chain finance, securitization, and co-lending. This helped Yubi secure 45% of the market share in market-linked debentures. Through a flexible, user-friendly experience, we facilitated over ₹13 crores in investments, providing easy access to a wide range of services based on clients’ specific needs.

Combating Emotional Investing and Empowering Users to Trade Wisely with Geojit

-

- Region: India

-

- Target Demography: Individual investors who lack expertise in trading and are prone to making emotionally driven investments.

Investors often make investment decisions based on emotional reactions, leading to suboptimal outcomes. This phenomenon, known as emotional investing, negatively impacts financial returns. To combat it and help users make sound financial decisions, Geojit sought our help to design a platform that offers guidance on wise investing and trading while managing investments effectively.

To address emotional investing through design, we provided a user-friendly UI with educational content and rich data visualization, simplifying the investment into various steps. The web application features responsive design for seamless accessibility and uses visual design and illustrations to break down complex information into easy-to-understand tidbits. Through the simplified process, more users were able to break their emotional investing patterns and learn industry knowledge. Doing so, improved the average ROI of the investor by 50%.

Rewiring Income Tax Filing as A Pleasurable Experience for ClearTax Through Simplified Design

-

- Region: India

-

- Target Audience: Tax Payers

Income tax filing in India is a traditionally daunting process. It involves gathering documents, navigating many application forms, often resulting in a hunt for forgotten paperwork. This cumbersome experience leads to low filing rates, missed benefits, and a negative perception of taxes.

To make this process an enjoyable experience, NetBramha built a simplified tax filling design for ClearTax. We focused on streamlining workflows with step-by-step guidance and automation features. This catered to over 25 different user profiles, ensuring a smooth experience for everyone. By replacing the complex tax language with easy to understand explanations and helpful tips, we were assisting users to make informed tax decisions.

We redesigned the tax filing process. It now works better for over 2.5 million Indians and 40,000 organizations. The new ITR design process reduced the time required to file taxes to under 7 minutes. This time reduction resulted in saving 2 million man-hours amongst personnel.

End-to-End Digitization of Gold Lending Process for One Muthoot

-

- Region: India

-

- Target Audience: Individuals seeking gold loans who prefer a convenient, digital solution over traditional pawnbroker visits.

Gold lending, while longstanding, has traditionally been disorganized and reliant on physical infrastructure. Despite digitization efforts, the digital gold loan market remains underdeveloped, with few providers offering a hassle-free, fully online experience.

NetBramha designed for One Muthoot, a comprehensive gold lending application that simplifies the borrowing process, making it easy, seamless, and judgment-free. We digitized the entire gold lending process, allowing users to apply for and manage gold loans entirely online, eliminating the need for physical visits. The process ensures a smooth and straightforward borrowing experience, creating instant delight and skipping judgment. The app also facilitates easy exploration of other financial products offered by One Muthoot, significantly increasing user engagement rates and product discoverability due to its transparent and intuitive platform.

Enhancing Employee Retention and Hiring Efficiency for ICICI Prudential

-

- Region: India

-

- Target Audience: Banks seeking to retain employees and hire candidates who are well-suited to their roles.

Recruitment teams in the fintech sector, especially for customer-facing roles, experience challenges in maintaining high employee retention rates. With a growing younger population, turnover rates are increasing, and the average tenure for entry and mid-level positions are decreasing annually. To address this, ICICI Prudential partnered with NetBramha to create an intuitive job application portal to streamline and automate the hiring process.

The portal revamped the candidate assessment journey by improving the application flow, providing real-time critical information, and educating candidates about frontline sales jobs to enable informed career decisions.

To tackle sporadic hiring and low retention, we implemented a user-friendly design, making the application process smooth. We added modules to educate candidates about the demands of frontline roles. This optimization increased the ratio of applicants to selections, ensuring a better fit between candidates and roles, thereby reducing attrition.

Encouraging Financial Literacy Amongst Pre-Teens and Teens for IAMIN

-

- Region: India

-

- Target Audience: Children, teens, and young adults in India seeking to improve their financial literacy.

Financial literacy matters the most for the younger generation, yet national surveys show that less than 5.5% of schools in India teach financial education. Children and teens need early financial skills to make informed decisions about careers, education, and money management. With increasing access to financial products, they are also at risk of fraud and scams.

In partnership with IAMIN, NetBramha designed a gamified financial literacy platform for various age groups and financial expertise levels. The platform teaches the “language of money” through engaging, interactive methods, helping kids and teens build better financial habits by linking goals and tasks to earning and investing money.

The interactive design experience makes financial education exciting and engaging for children, motivating them to keep learning. All educational content is delivered in a goal-oriented format, helping children build habits and incentivizing learning.

Building GoalTeller, an Intuitive Financial Planning Tool that Adapts to Users’ Lifestyles

-

- Region: India

-

- Target Audience: Individuals who are interested in financial planning

Many financial planning tools fail to adapt to users’ evolving lifestyles and needs, leaving individuals struggling to turn their financial ambitions into reality. There is a need for a solution that offers personalized, dynamic financial planning to help users achieve their future goals and build positive financial habits.

GoalTeller sought the help of NetBramha to design a smart and intuitive financial planning platform that offers personalized financial advice and engaging gamified workflows. The platform adapts to users’ lifestyles, helping them turn ambitious, future-oriented financial goals into achievable plans.

To create GoalTeller, some critical aspects that we highlighted in the design were personalized financial planning, the ability for the design to dynamically adapt to the new user, and gamification of workflows. These design frameworks helped GoalTeller increase its engagement and retention rates. Overall, the design helped users plan major life events by providing them with a well-rounded financial strategy.

Do you have a fintech challenge you are dealing with?

We can solve it through design.

Learn how

Bringing Access to Educational Content for Financial Advisors With White Owl Wealth

-

- Region: India

-

- Target Audience: Financial advisors seeking to enhance their skills and expertise

Financial advisors face a significant gap in access to comprehensive educational resources, hindering their ability to stay updated with the latest tools and knowledge necessary to effectively serve their clients.

For White Owl Wealth, we designed a holistic learning and upskilling platform specifically targeted at financial advisors. The platform provides a single location for advisors to access the right tools, knowledge, and resources needed to nurture client relationships and rapidly evolve as experts in their field.

To address the educational gap for financial advisors, we focused on strategies that created end-to-end learning modules covering a wide range of topics. The platform with a single sign-on consolidated all educational tools and resources, making it easy for advisors to find what they need. The comprehensive but simple design closes the knowledge gaps by understanding the users and the level of experience in the industry, facilitating smoother transitions and continuous professional development.

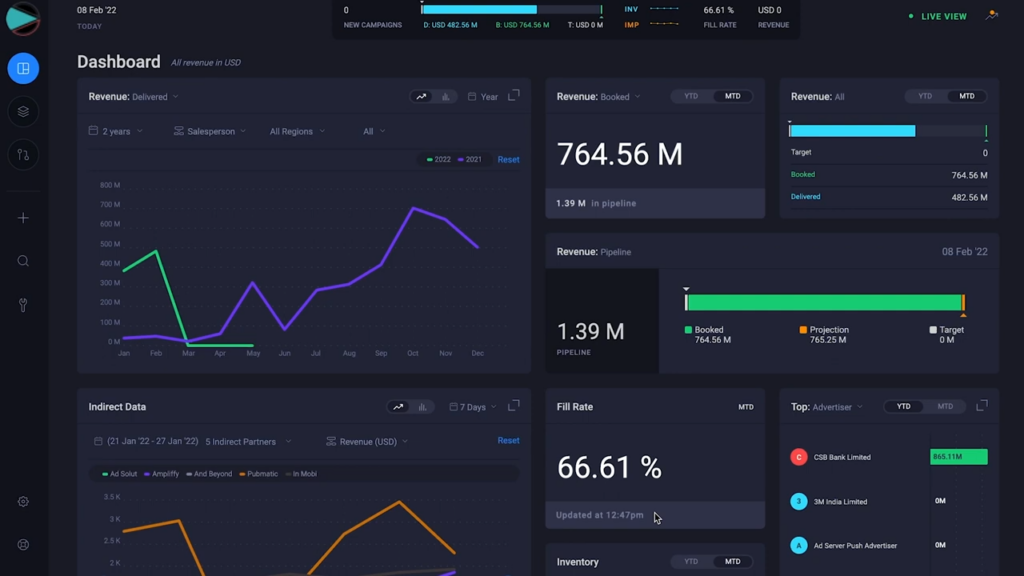

Innovating Enterprise Revenue Management for Voiro

-

- Region: India

-

- Target Audience: OTTs, media houses, and online retailers looking to streamline and enhance their ad monetization efforts.

The channels through which we consume content are constantly evolving, forcing media houses and other platforms to find creative ways to monetize their content. To tackle the lack of structure in the ad monetization of media, NetBramha designed Voiro, a one-of-a-kind platform. This platform seamlessly tracks and optimizes digital, online retail, and media ad monetization.

The platform we designed empowers publishers to achieve sharper monetization. The design helps ad businesses reimagine operations and analytics across the ad value chain by leveraging automation, predictive capabilities, machine learning, and AI. The aim was to create a hassle-free process to buy, manage, and explore ad monetization.

We focused on keeping the Voiro platform’s design simple and scalable, allowing it to grow with customers. The user interfaces were intuitive and easy to navigate, enabling users with no subject matter expertise to quickly access and understand key data. The design’s simplicity came from precise and reliable data visualizations that help users make informed decisions.

Simplifying Credit Assessment Process and Business Health Monitoring for Crediwatch

-

- Region: India

-

- Target Audience: Individuals and businesses worldwide, with a special focus on SMEs.

To make any financial decision or an investment, businesses need to stay on top of their credit scores and business health. They need a financial services expert that gives them a seamless experience across devices in real-time, fuelled by data-driven insights.

The Crediwatch platform, designed by NetBramha caters to that very specific need. The platform provides comprehensive credit assessment and business health monitoring tools that help you make sound decisions.

At NetBramha, we designed a platform that offered simple, flexible, and seamless web flows that enable users to make data-driven business decisions independently. The platform provides accurate insights into company operations, tailored for SMEs, with subscription-based and transactional models.

To deliver comprehensive credit assessment and business health monitoring, we opted for simplified web flows. Given the company’s complex, process-oriented solutions, we prioritized flexible web interfaces for effortless navigation. Ensuring seamless integration across various devices, the platform design is compatible with multiple devices and screen resolutions, allowing users to access services seamlessly.

Enhancing Accessibility to Liquid Staking and Portfolio Management with Persistence

-

- Region: Worldwide

-

- Target Demography: Gen Z and Crypto investors

Gen Z investors prefer to choose platforms that simplify the liquid staking process and manage portfolios digitally within the cryptocurrency space. According to a survey by the CFA institute, almost 53% of Gen Z choose a platform based on how easily they can open an account on the platform. This shows there is a need for a platform that simplifies the process and appeals to younger investors.

In collaboration with Persistence, we designed a one-stop shop for liquid staking and portfolio management. The platform facilitates easy borrowing of crypto assets using real-world assets as collateral, tailored to Gen Z preferences.

Persistence offers a comprehensive service for buying, trading, and staking crypto assets. The design is smart, intelligent, and appealing to Gen Z investors while also enabling experienced investors from different age groups to navigate seamlessly. The design’s simplicity and advanced technology appeal to a wide age group, highlighting the platform’s powerful features.

Forging Design Experiences that Lead to Ultimate Business Success

Many startups and growing companies struggle with product development, missing vital insights and making mistakes that drain resources. The culprit? Often, it’s a lack of investment in crucial areas like expert research, testing, and design.

Outsourcing your fintech product strategy, design, and development to domain professionals can be a game-changer. By leveraging our deep industry knowledge, you can avoid the pitfalls that sink many Fintech ventures.

NetBramha is your partner in building a winning fintech product.

We’ve harnessed the power of research-driven strategy, design, and end-to-end services to create over 25 successful fintech products. These products have not only secured hundreds of millions in funding but also earned recognition from industry giants.

Let us help you build a fintech product that thrives.

If you are looking to build a product that is smart, intuitive, and supports your business growth. Connect with our expert team now.