Domain

Finance & Fintech

Platform

Mobile App

Services

Research, Strategy

Teaching the language of money in exciting ways.

IAMIN, a financial literacy platform that enables users of all ages to become financially independent. Using methods specifically developed for all types of learners, IAMIN is a one of a kind platform that helps users understand the six most important quotients of Financial Literacy: Spend, Save, Donate, Invest, Earn & Learn.

Challenge

Creating a holistic financial literacy platform that makes learning fun & engaging while also teaching kids & teens the importance of financial awareness right from a very young age. We wanted to also empower users from all age groups – right from school-going children to working professions (with differing financial know-how) all the way to senior citizens through different forms of rich, interactive & customized content formats built on scientifically-backed learning frameworks.

Solution

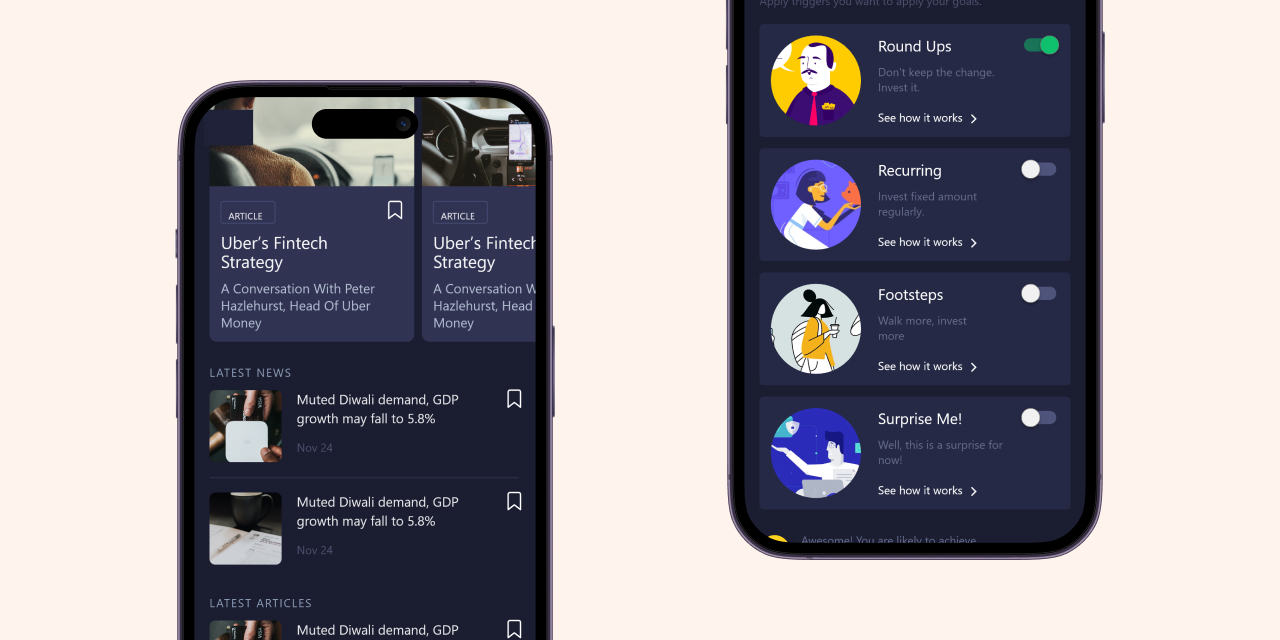

A highly gamified financial literacy platform optimized for the complete gamut of end-users, from different age groups & financial expertise teaching them the language of money in exciting ways. Our design focused on empowering kids & teens build better habits by tying these goals & tasks to earning/investing money in diverse ways by keeping them thoroughly engaged on the platform.

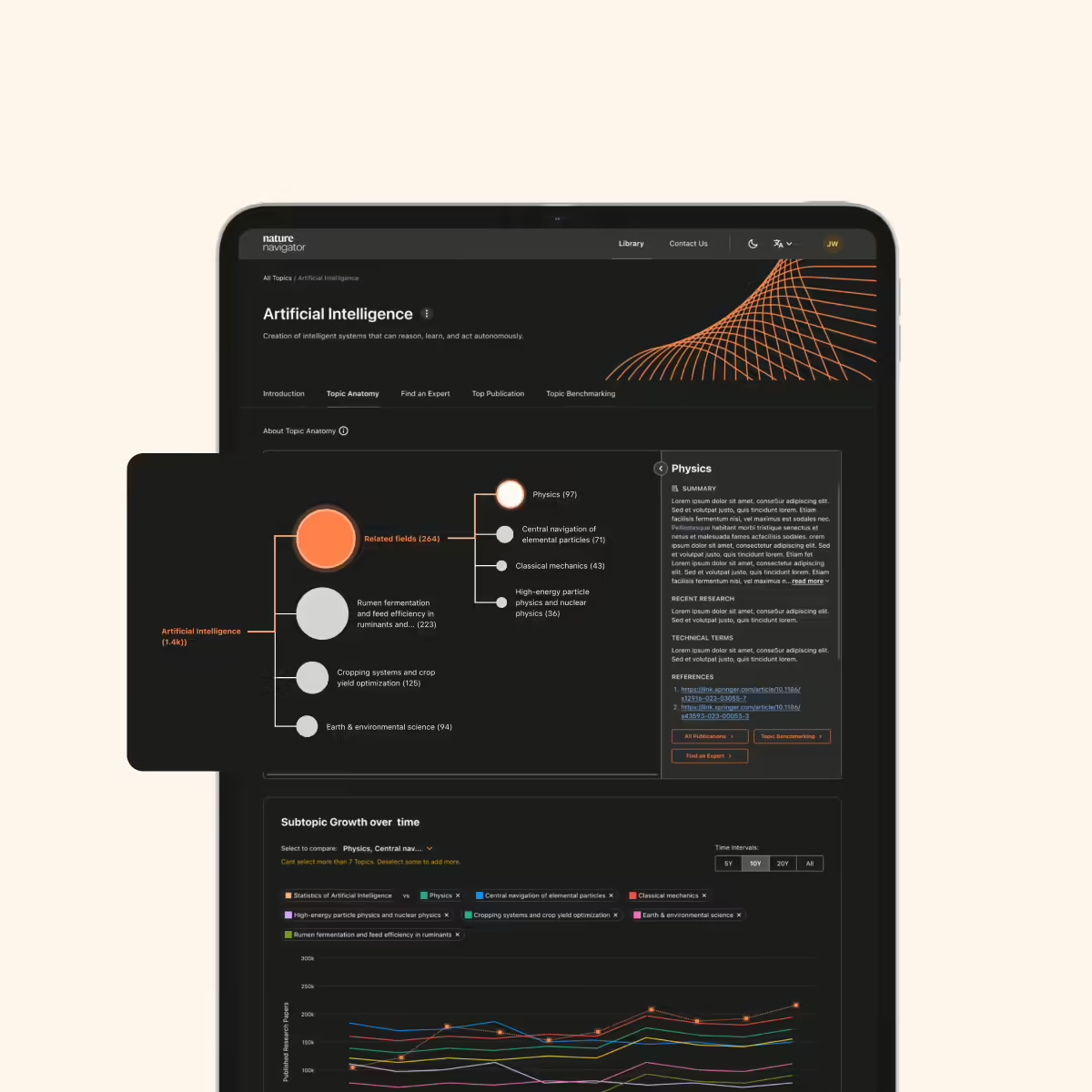

Research

In-depth research across different scientific learning frameworks that facilitates faster, consistent & continued learning for people from all age group. We also researched into different investment modules keeping in mind complete financial regulations & compliance, along with exploring different behavioral models on enabling kids build sustained good habits. Our research was also focused on different gamification principles which could be utilized to build a robust financial literacy platform.

Pain points discovered

Financial

Literacy

Is a difficult niche to crack since people often get overwhelmed or intimidated with different aspects of financial knowledge

One stop

destination

Lack of a single, holistic financial literacy platform that caters to all age groups, since no school/college teaches this

Engaging

users

Building sustained habits of increasing financial awareness by keeping users engaged on the platform

Strategy

Our design-first thinking framework enabled us to strategize cogent design solutions that could tackle existing pain points & transform the brand as THE go-to place for enhancing financial literacy & awareness. Our product strategy focused on implementing the right scientific learning models along with principles of gamification to create a first-of-its-kind gamified financial literacy platform that unlocked learning for users from 6-60+ years of age.

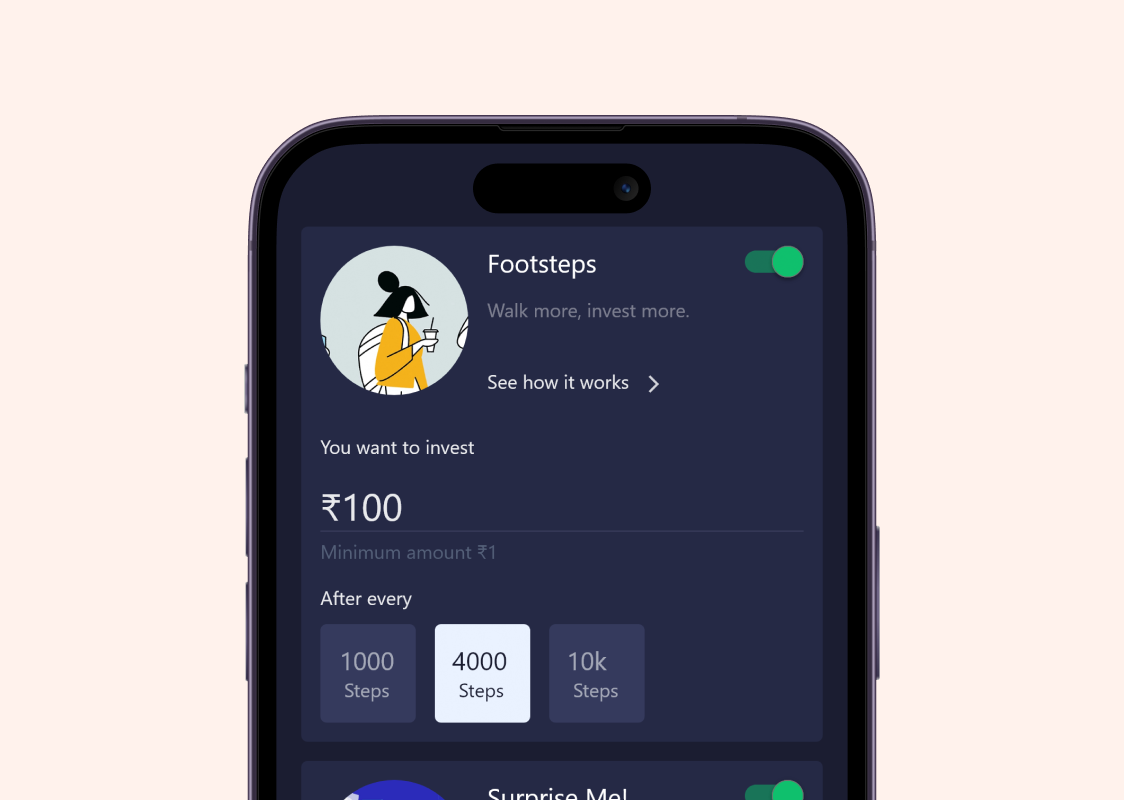

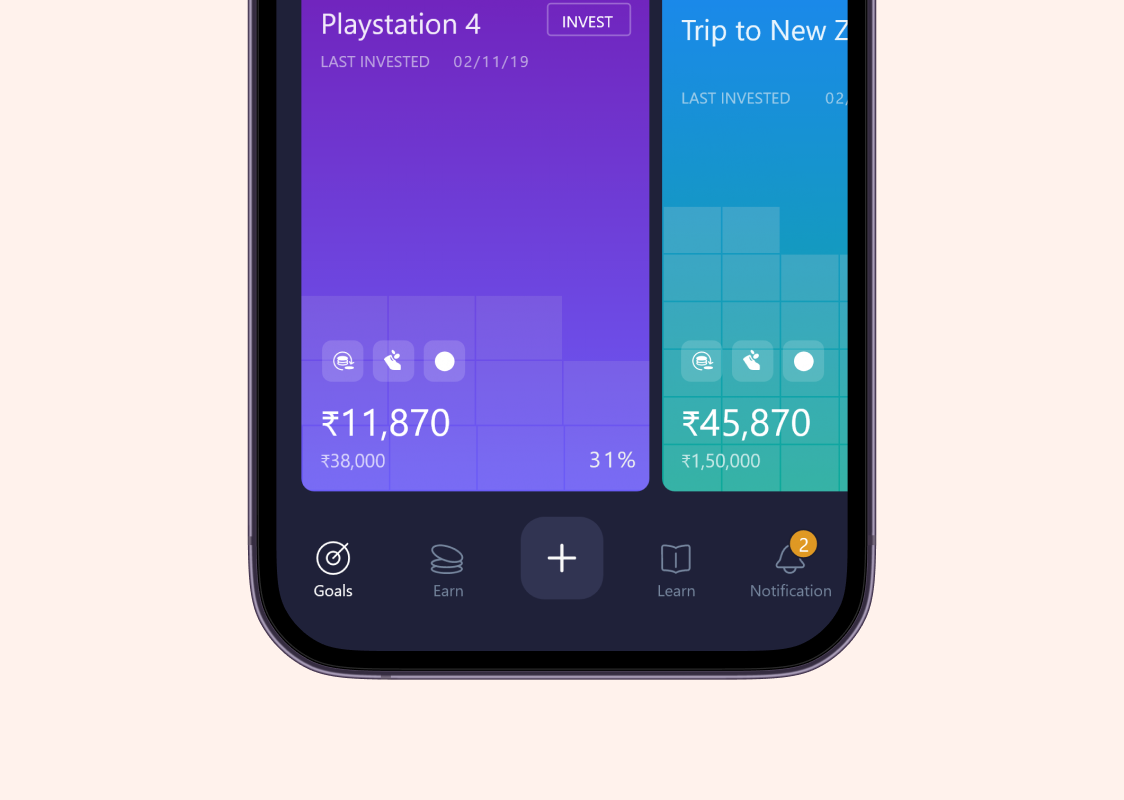

We gave teenagers all the control over how & where they would like to spend/invest their money & broke down big goals into smaller micro goals that made it super easy for the users to connect earning & learning with building healthy habits.

SPEND to save

Scientific learning framework that works for 6-60 yrs old users.

User Personas

Complete gamut of users- from kids to working professionals to senior citizens

Learning formats

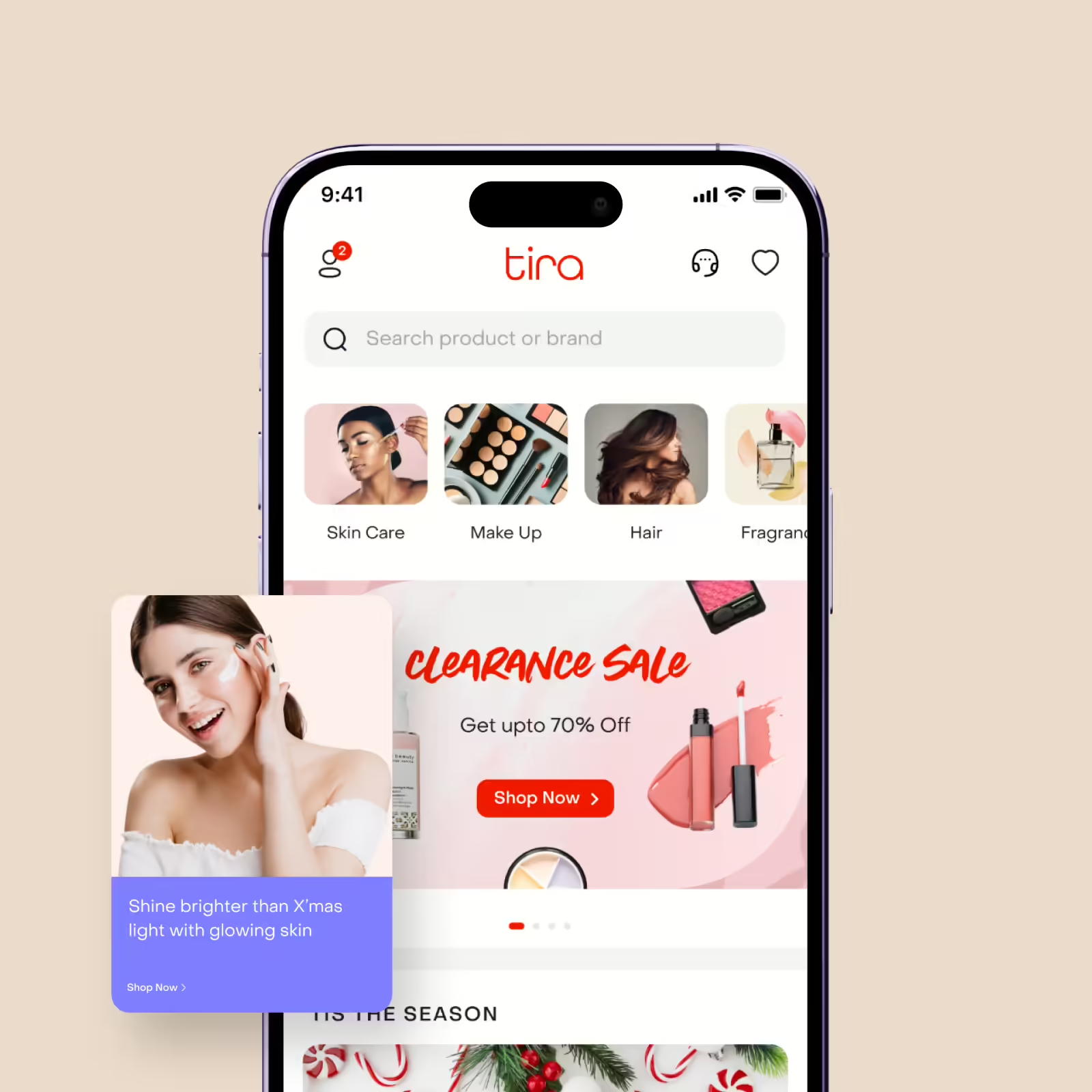

Wide range of content formats designed for each user group

Design

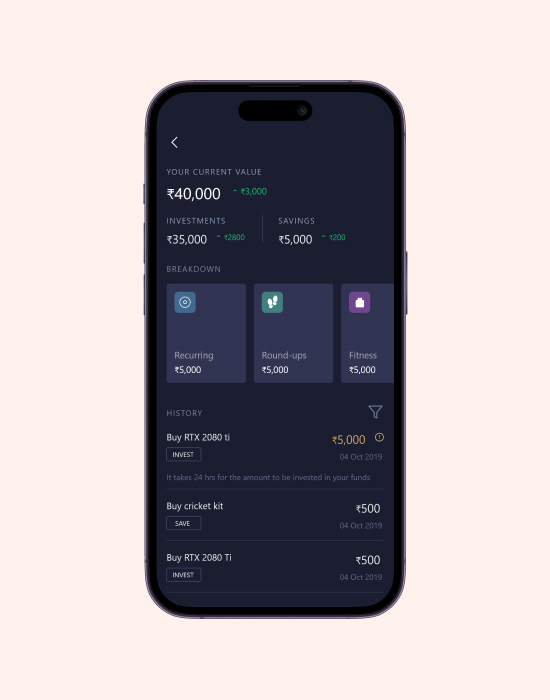

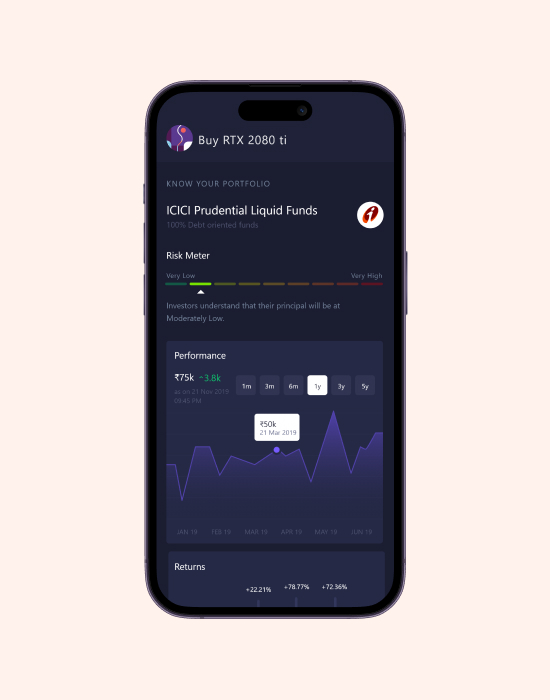

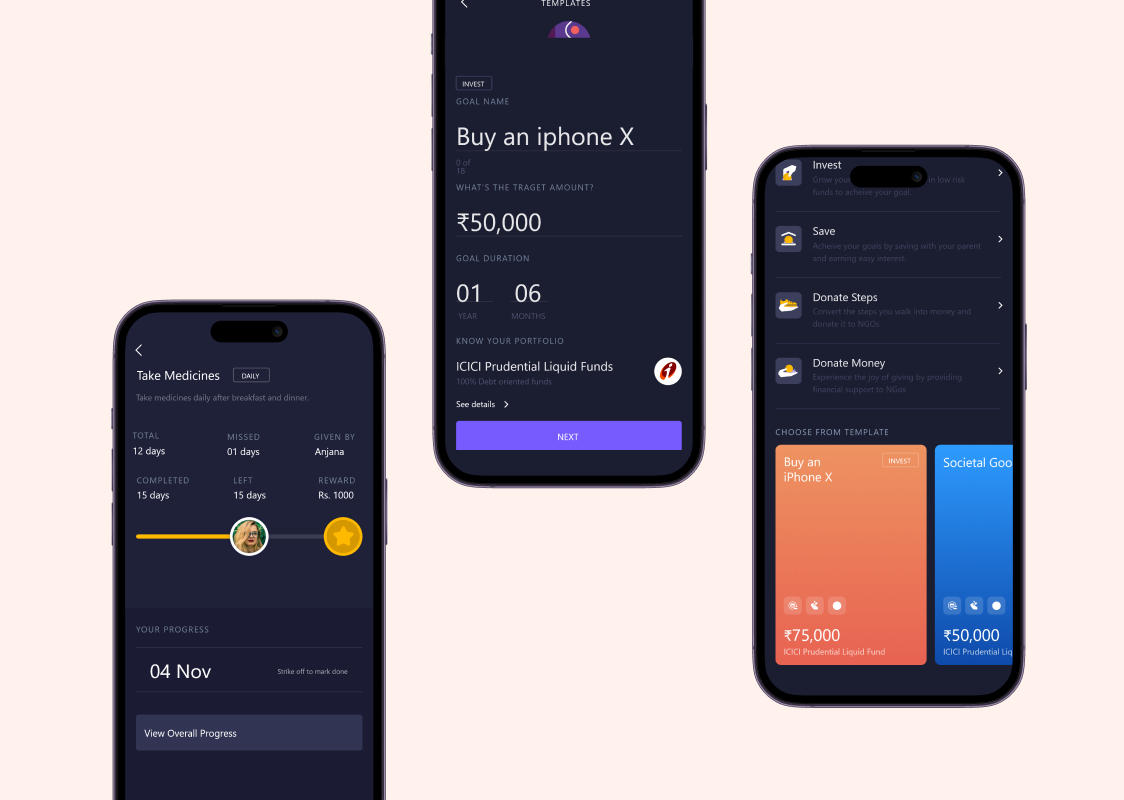

A thoroughly gamified ecosystem where kids can earn money from their parents by practicing good habits & also explore different ways to invest the money – a unique factor that enables children inculcate healthy habits & also augment their understanding of the financial world. Diverse set of content formats, customized to different target user groups gave IAMIN an opportunity to further penetrate & disrupt the market by facilitating the right pace & format of learning for different groups.

Every time the user performed a task (related to healthy habits like exercising), they would earn some amount of money & had the freedom to choose where they would want to spend/invest/donate this sum. This entire design solution complied with all regulations & policies. Eg: The onboarding, adding bank details & other information were done with the consent of the parents.

Low fidelity wireframes

Workflows customized & optimized for different age groups & financial know-how to stay from one-size-fits-all approach to design, making financial knowledge accessible to all.

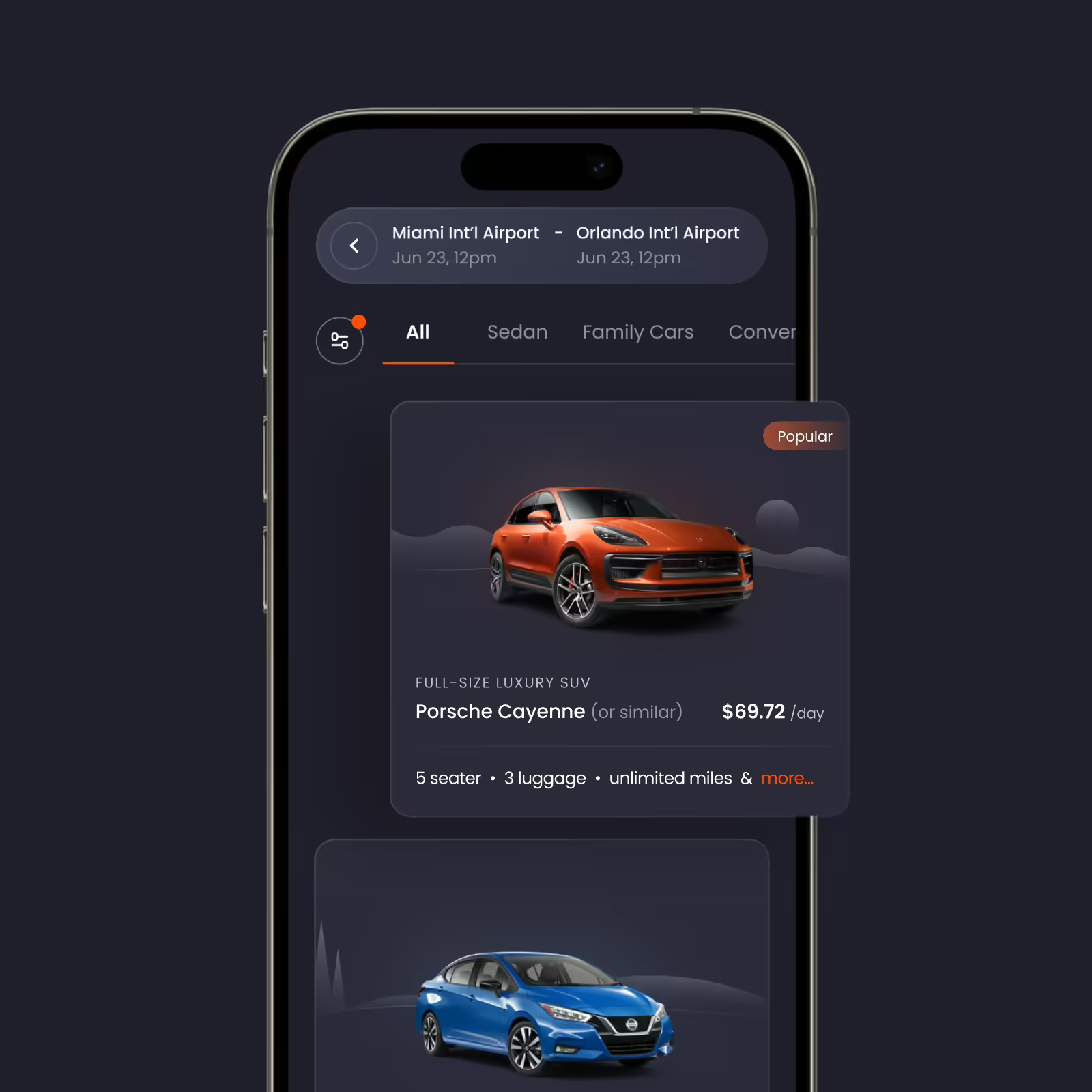

Visual design

Dark modes, high contrast & bright hues used across the platform to ensure high engagement & excitement in a financial literacy platform. Custom iconography & illustrations to give the brand the feel of a unique learning platform that is loved by users from all age groups.

Outcome

Equipped with scientific learning frameworks, behavioral psychology, in-depth financial knowledge & user-centered designs, we were able to design an innovative financial literacy platform that not only taught the language of money in exciting ways to kids & teenagers but also enabled working professionals & even senior citizens turn more financially prudent.

With customized workflows & a diverse array of learning content formats for different age groups, our design solutions for IAMIN ensured a highly accessible & inclusive learning platform within the finance ecosystem.

Discover how NetBramha can help you build fintech products of the future by building robust user-centric products that not only serve but delight your users. Connect with us here.