Domain

Finance & Fintech

Geography

India

Platform

Mobile App

Services

Strategy, Design

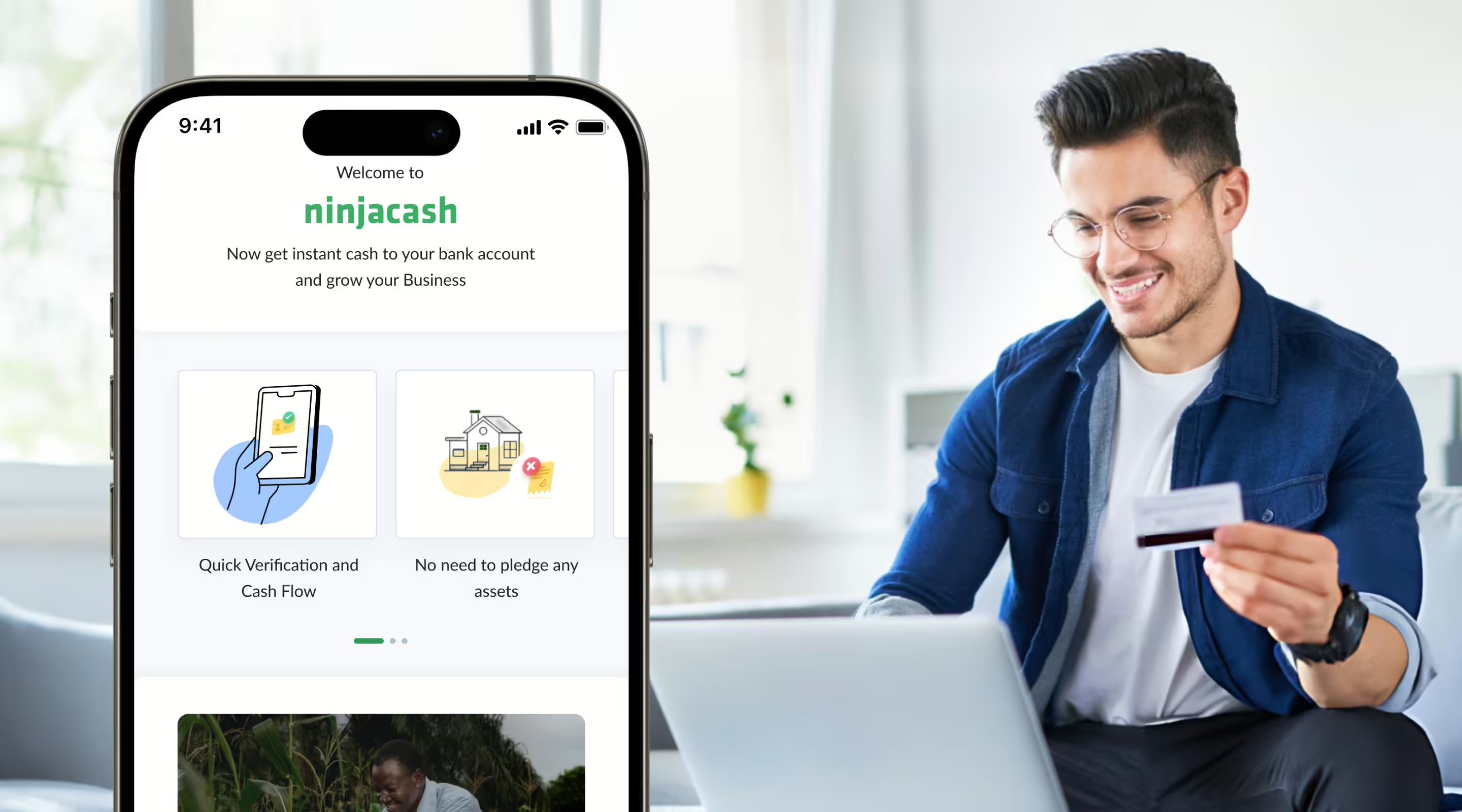

Creating a frictionless, transparent, and inclusive digital lending platform.

Ninjacart, India’s largest fresh produce supply chain company, sought to tackle a critical challenge for their B2B customers: ensuring seamless financial access to manage cash flow disruptions. To address this, they envisioned NinjaCash, a dedicated vertical aimed at digitizing the loan lending experience.

They partnered with NetBramha Studios to bring this vision to life. With our expertise in crafting intuitive and impactful digital experiences, we were tasked with designing a solution that would enable users to effortlessly apply for, monitor, and repay loans within a unified platform. By leveraging our user-first approach, Ninjacart aimed to eliminate physical dependencies, streamline processes, and empower resellers to overcome cash flow challenges effectively.

Challenge

Ninjacart identified a pressing challenge faced by their B2B customers—resellers, including retailers, restaurant owners, and crop producers—who often experience significant cash flow disruptions due to delayed payments from traders, typically taking 10–15 days after shipments are delivered. These delays impact business continuity and create financial strain. Addressing this issue required simplifying and accelerating the loan process, ensuring it was intuitive, paperless, and capable of delivering high approval rates with faster disbursements.

Solution

To address these challenges, Ninjacart partnered with NetBramha Studios to reimagine the loan experience through digital innovation. By leveraging Ninjacart’s extensive user base and deep understanding of B2B financial needs, we designed a dedicated mobile app solution that simplifies loan application, tracking, and repayment. The platform provides resellers with easy access to short-term loans against invoices, ensuring uninterrupted cash flow and enabling business continuity and growth. This approach not only streamlined the process but also offered valuable insights into the financial challenges of the B2B ecosystem.

Strategy

The product strategy for NinjaCash was deeply rooted in design thinking, ensuring the solution was not only functional but also empathetic to the unique needs of its users. We began by immersing ourselves in the resellers’ ecosystem to understand their financial pain points, workflows, and expectations. These insights formed a user-first strategy aimed at eliminating complexities in the loan application process while enhancing accessibility and transparency.

By adopting an iterative design approach, we focused on delivering a seamless, intuitive experience tailored to the diverse skill levels of resellers. The strategy prioritized usability through a centralized dashboard and dynamic features like personalized loan offers and EKYC integration, empowering users to make informed decisions. Each design choice was aligned with the overarching goal of enabling faster approvals and disbursements, fostering trust, and helping resellers maintain uninterrupted business operations.

User-Centric Design

The strategy prioritized understanding and addressing the specific needs and challenges of resellers.

Seamless Experience

Creating a simple, intuitive, and efficient platform to streamline the loan application process.

Trust and Transparency

The solution aimed to build trust by providing transparent information and personalized services.

Design

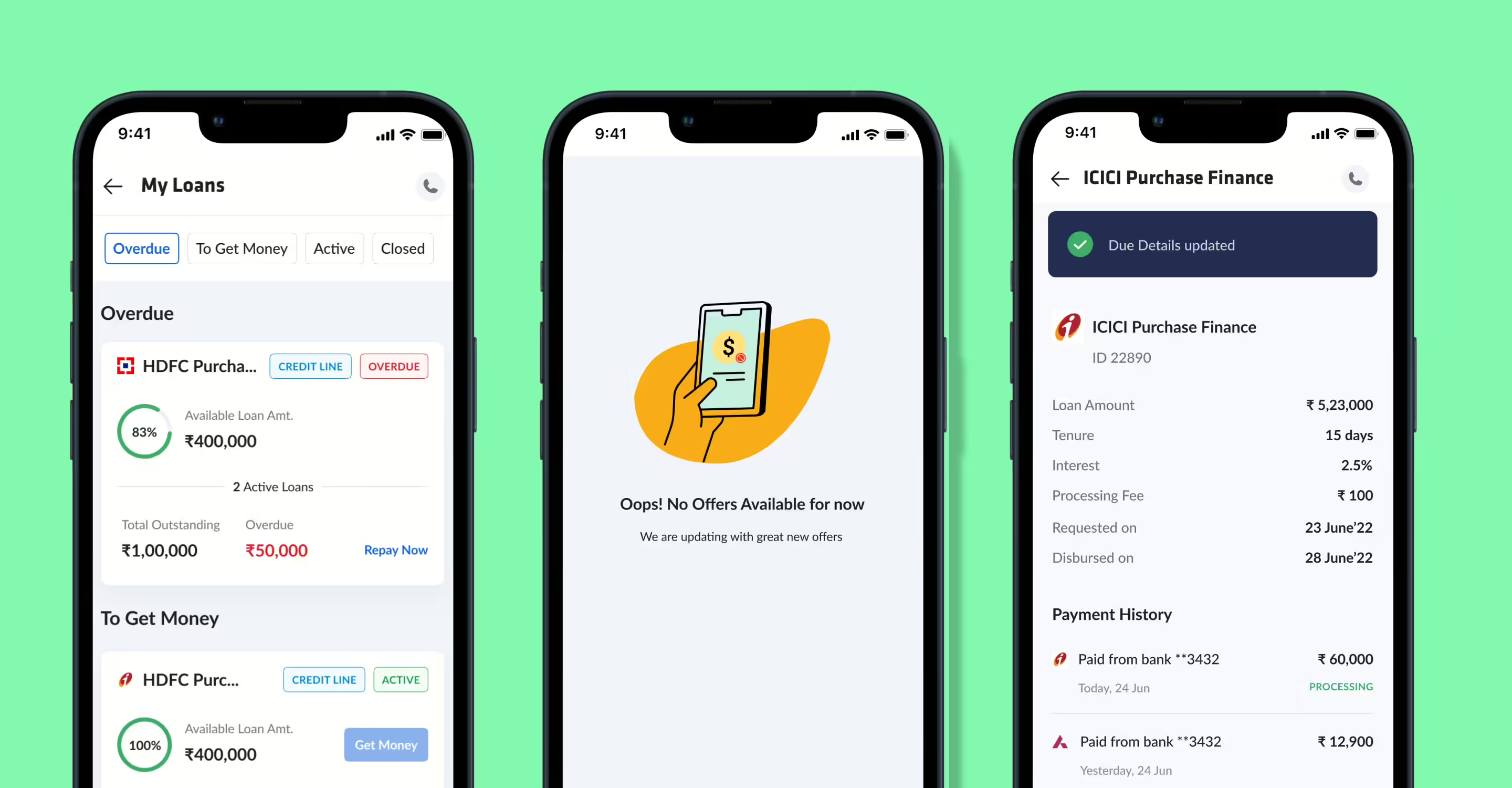

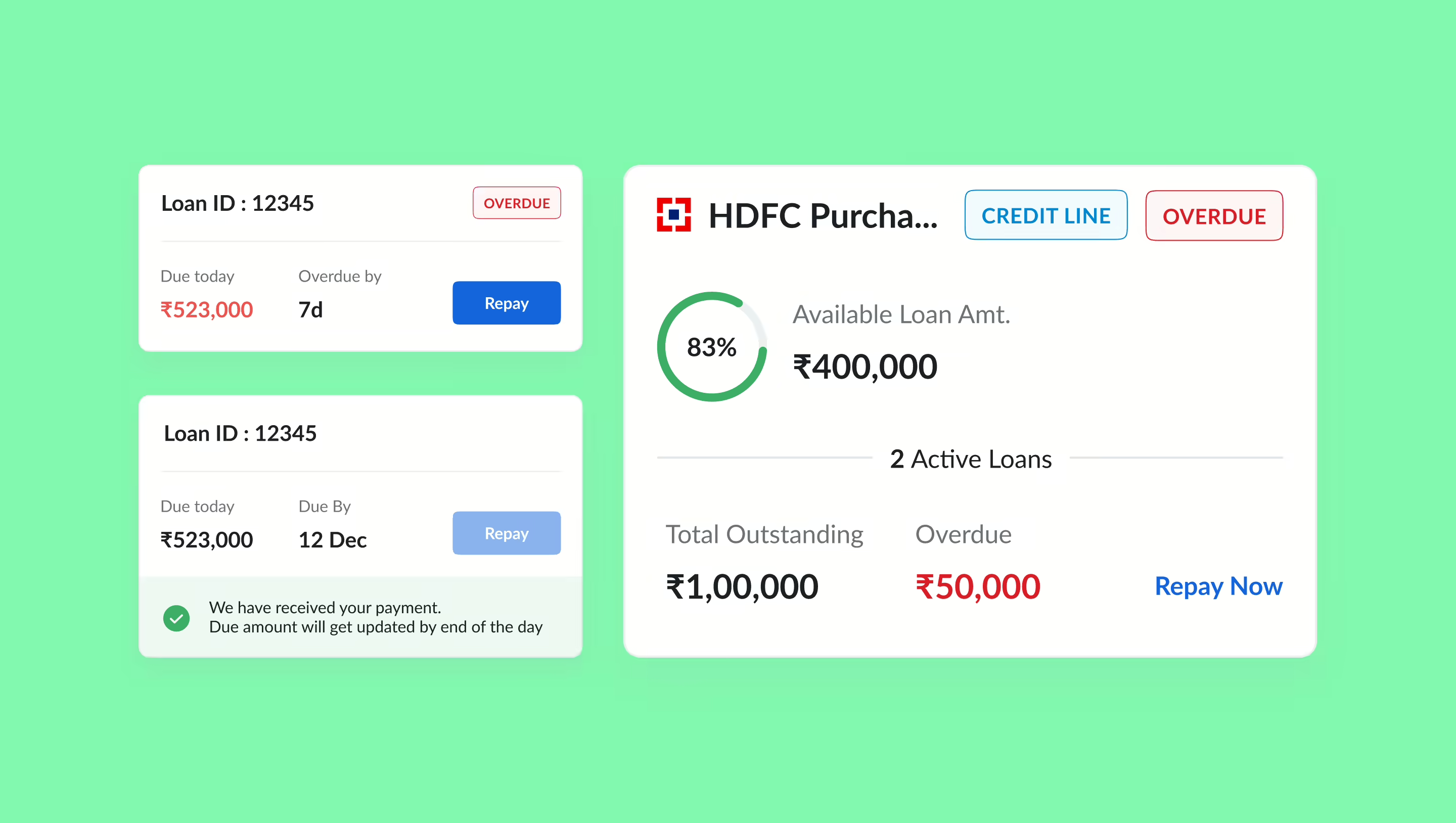

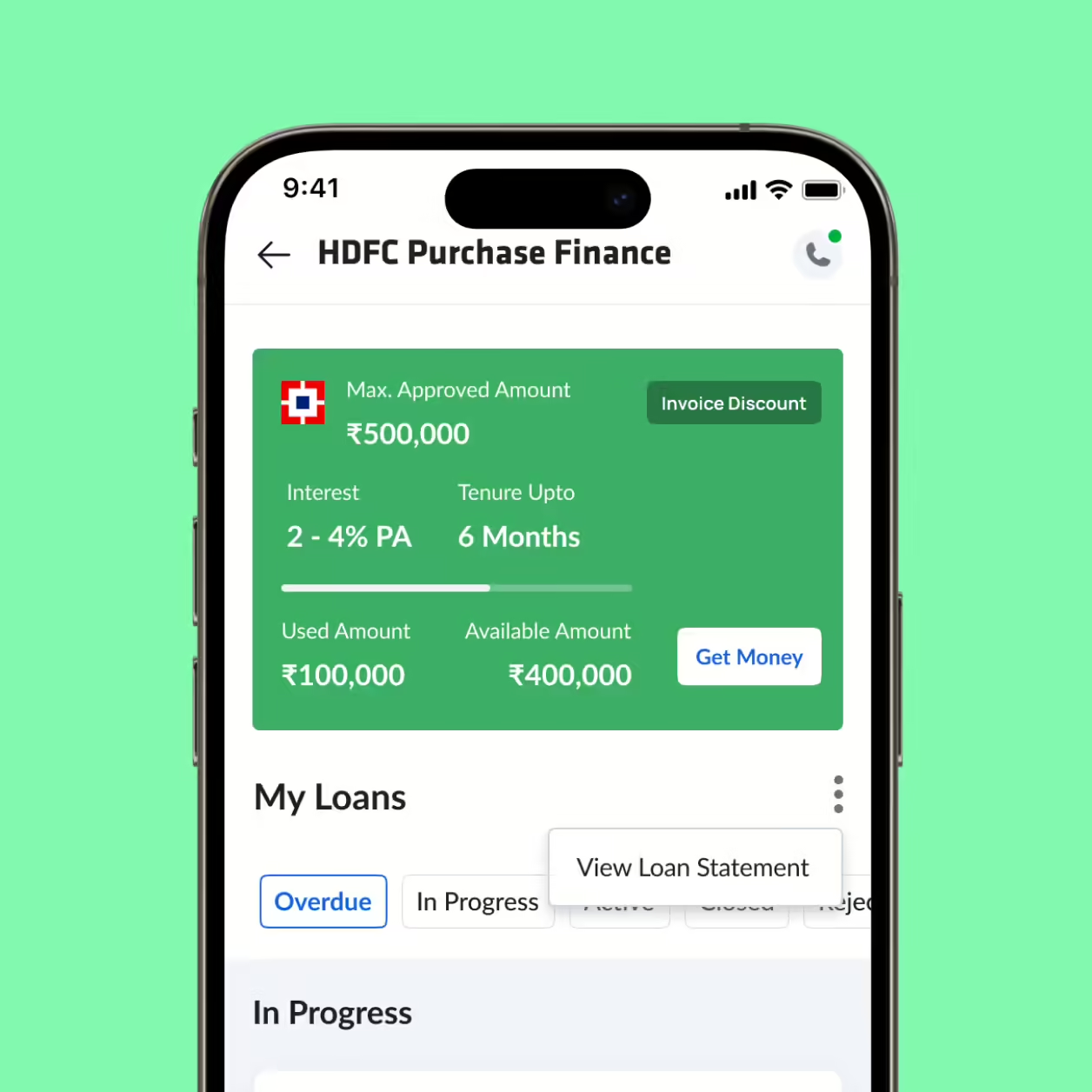

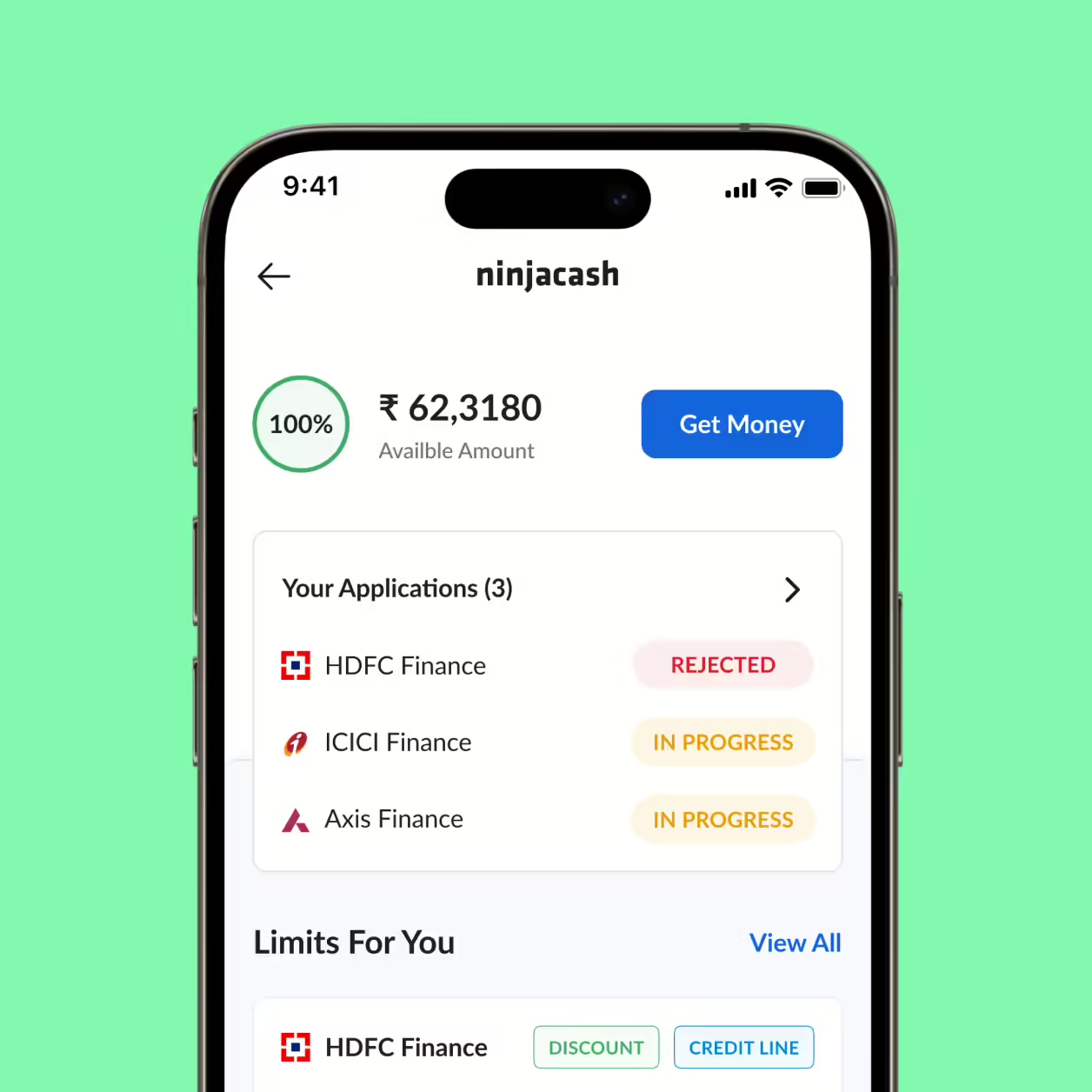

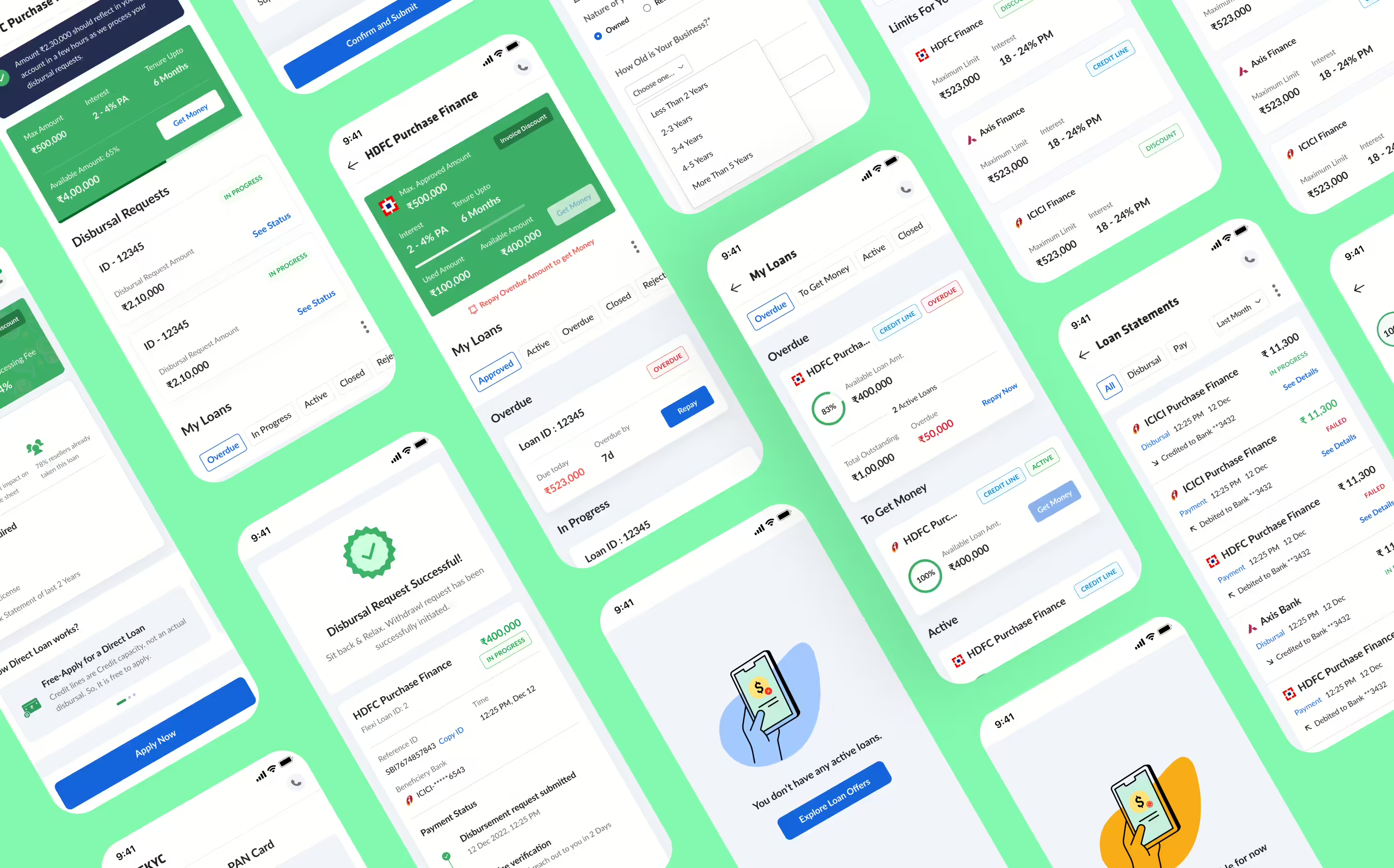

We focused on creating an intuitive and efficient mobile app that simplifies every stage of the loan process for resellers. At the core of the solution is a centralized dashboard, serving as a hub for users to seamlessly manage active loans, apply for new ones, or initiate repayments. This streamlined interface was crafted to minimize friction and empower users with complete control over their financial activities.

To enhance decision-making, a dedicated Loan Offers section was designed, enabling users to explore tailored loan options and access detailed information with ease. The integration of EKYC further transformed the experience by reducing manual effort, offering a streamlined document verification process, and providing real-time application status updates. By prioritizing a digital-first approach, the design reduced documentation requirements, accelerated loan approvals, and ensured faster disbursements, setting a new standard for managing business loans.

Outcome

The NinjaCash solution empowered resellers by improving cash flow and enabling better working capital management, effectively alleviating financial hardships. By facilitating end-to-end loan management entirely within the app, the platform streamlined the process, boosting approval rates and eliminating the need for cumbersome paperwork. This digital transformation also increased accessibility for underserved borrowers, expanding financial inclusion and providing a vital financial lifeline to resellers, retailers, and crop producers across India.