Domain

Finance & Fintech

Geography

India

Platform

Mobile application

Services

Research, Strategy, Design

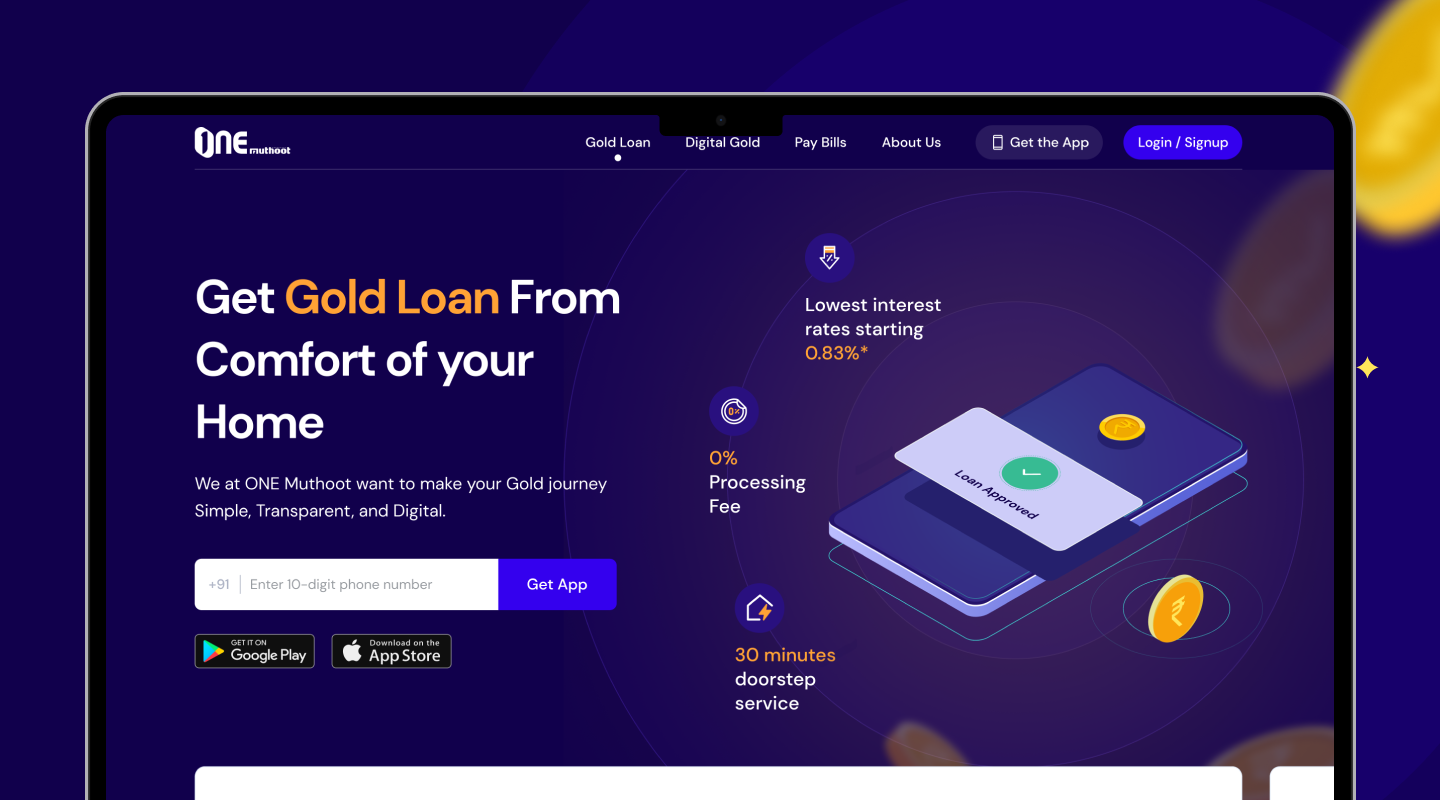

A modern design system for one of India’s oldest financial legacies.

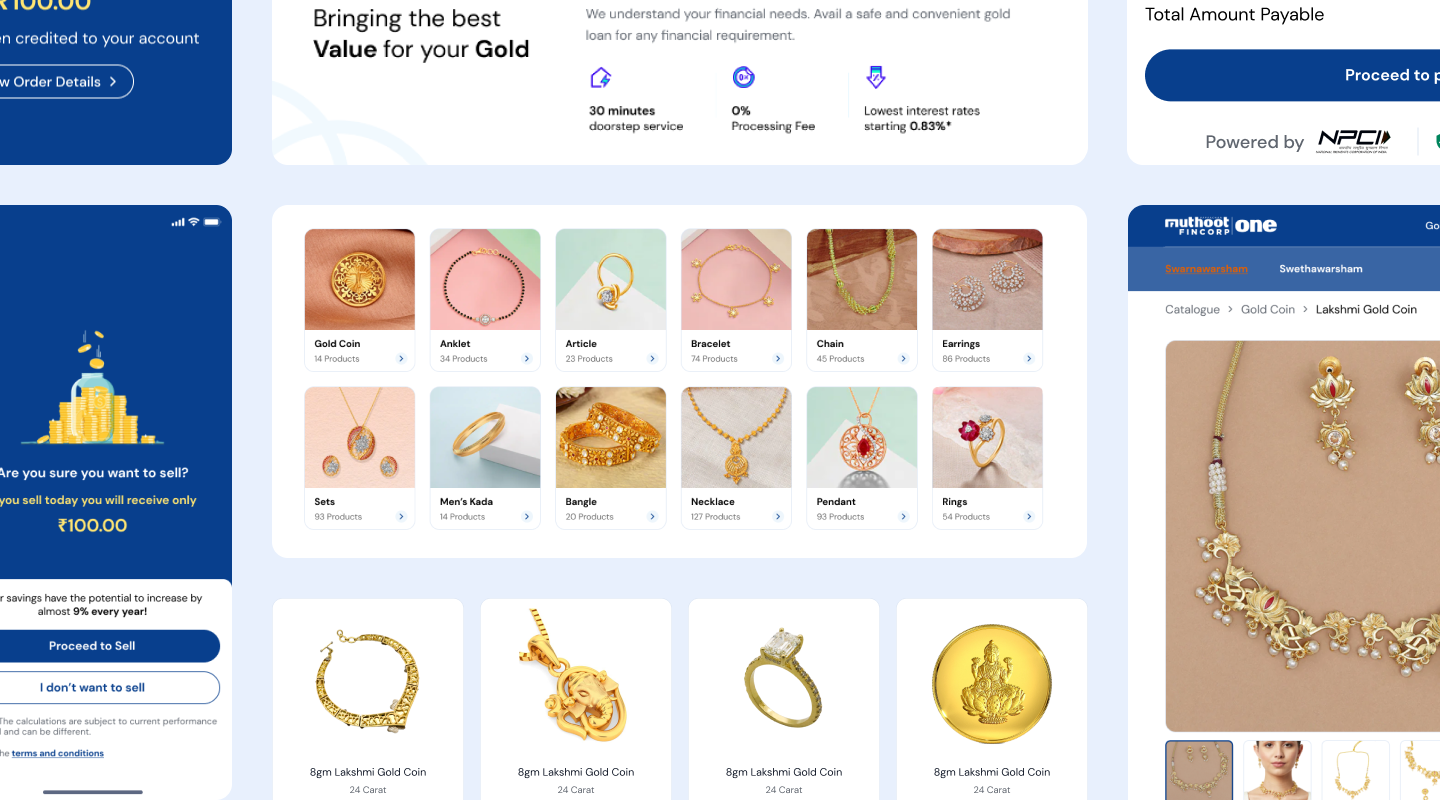

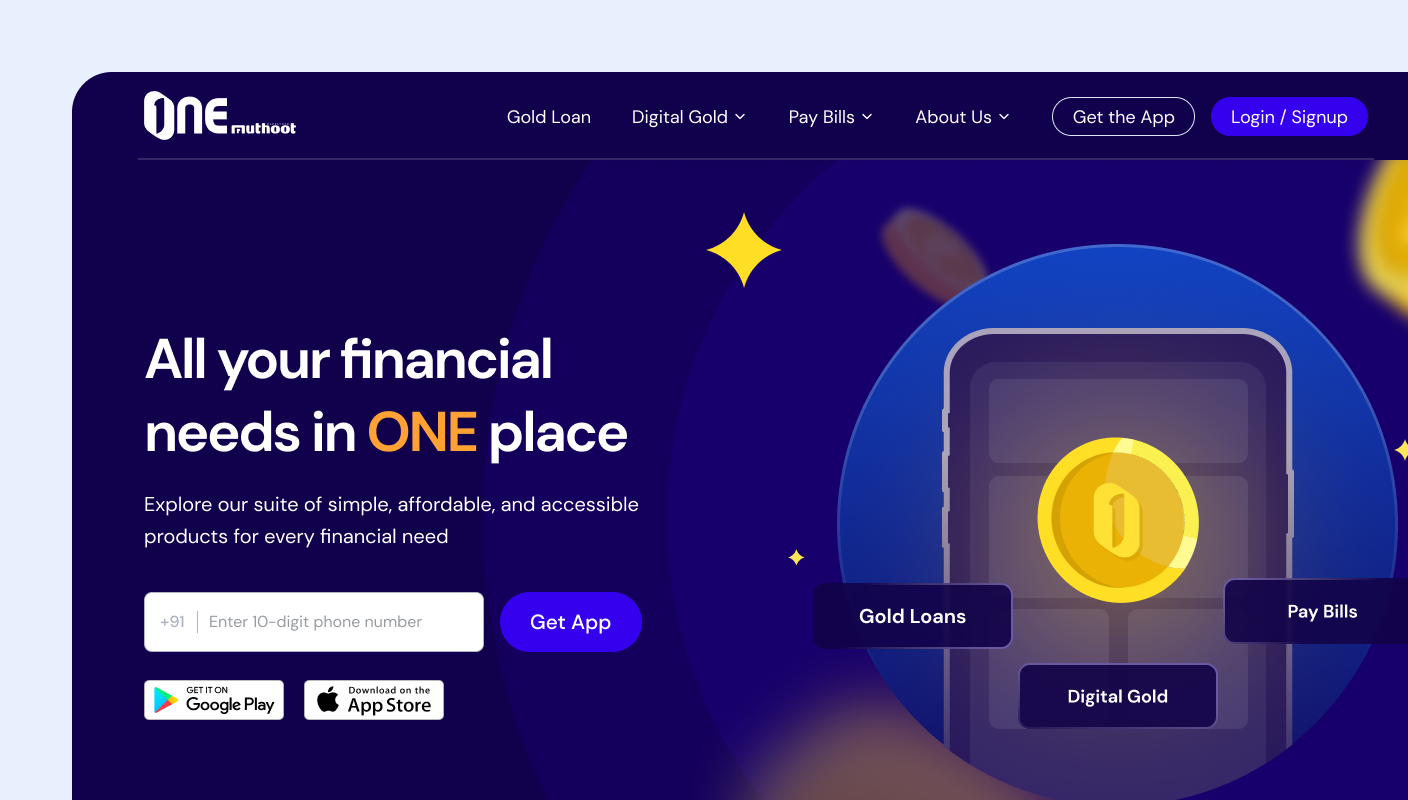

Muthoot FinCorp ONE is a financial institution that offers a wide range of financial services, including loans, investments, and insurance products. It is a subsidiary of Muthoot Pappachan Group, a well-known conglomerate in India. Our collaboration with ONE Muthoot aimed to transform the brand as a comprehensive financial ecosystem, offering convenient gold loan services from home, while maintaining high-quality standards. By modernizing financial services, ONE Muthoot sought to provide a secure, user-friendly experience and extend its services, broadening its digital finance footprint.

Challenge

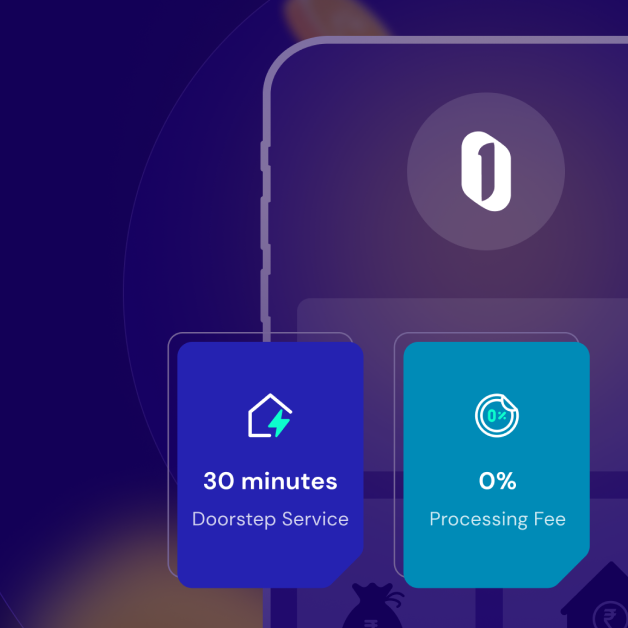

The redesign of the ONE Muthoot app encountered three primary challenges. First, it was essential to create a digital experience that effectively addressed the physical requirements associated with securing a gold loan. Second, understanding the complexities of Muthoot Fincorp’s traditional offline gold loan process was crucial for a successful transition. Lastly, transforming the perception of ONE Muthoot while maintaining the integrity of the brand’s identity and core values was a key consideration.

Solution

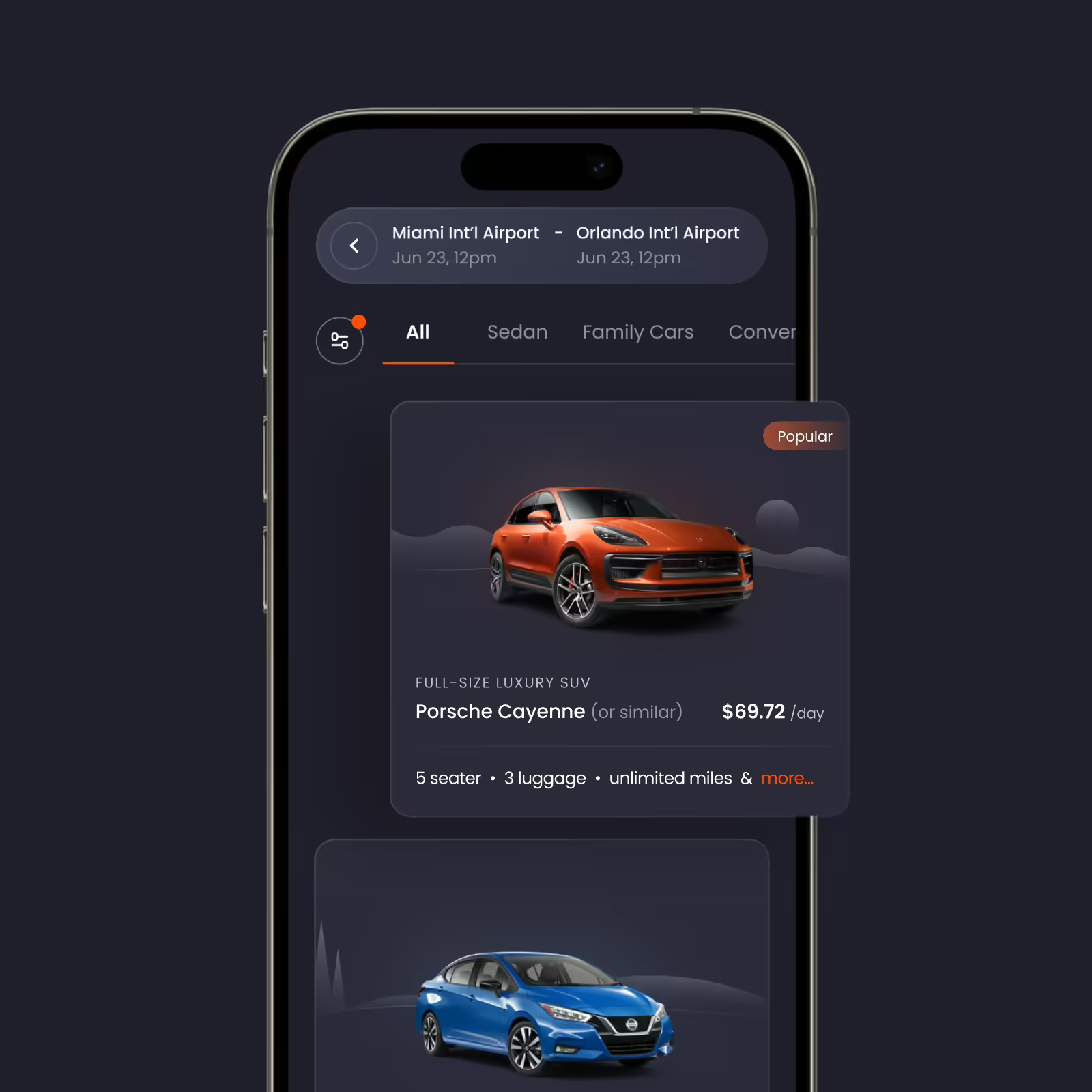

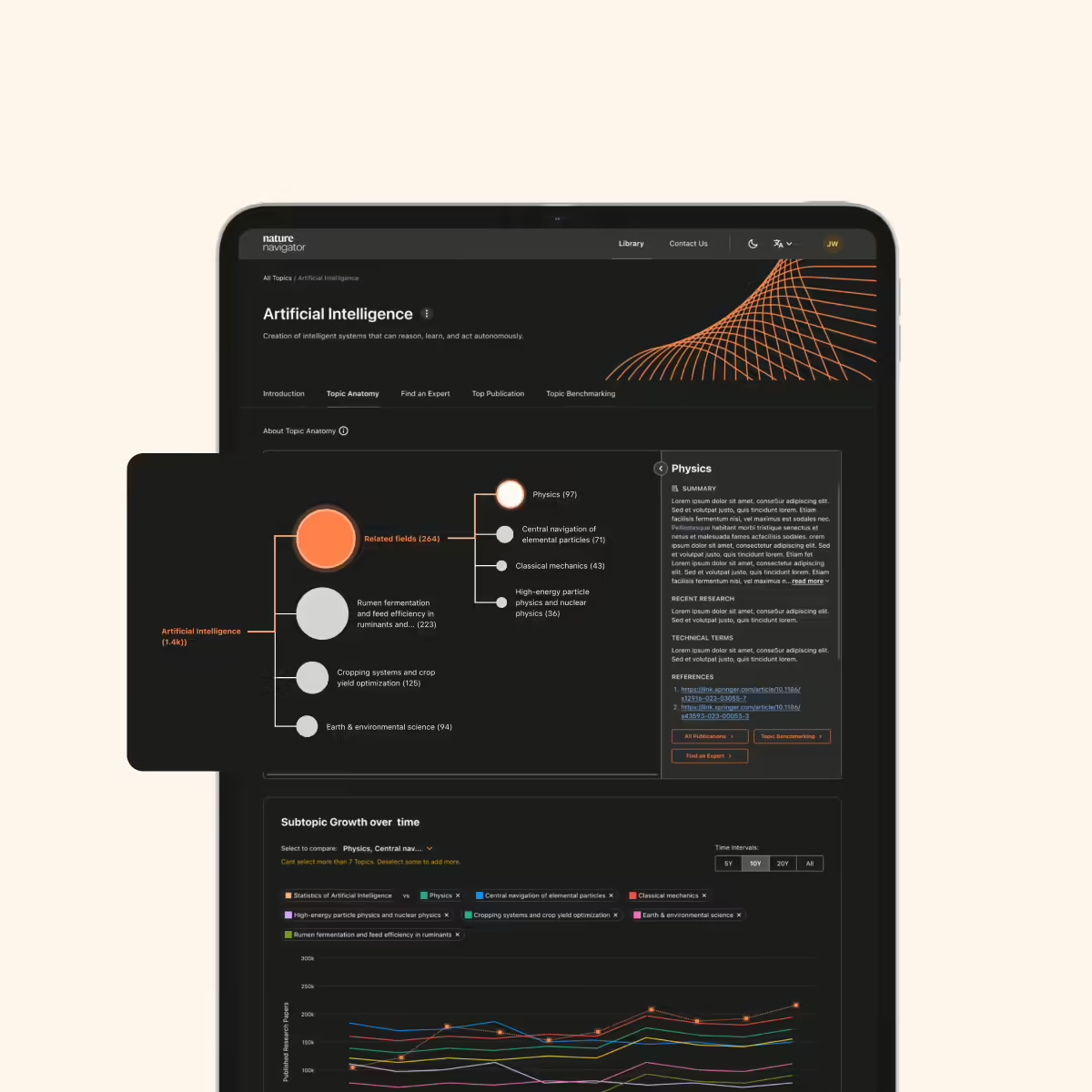

Our solution aimed at transforming the way people obtain and manage gold loans through a digital platform. This platform featured industry-first capabilities and can be extended to banks, lenders, and partners beyond MPG. It offered a scalable solution for consolidating multiple financial products from various sectors under one roof. By addressing the diverse needs and mental models of both existing and potential customers of Muthoot FinCorp, the platform aimed provide a comprehensive and user-centric experience.

Research

We began by researching and targeting tech-savvy individuals from metro and tier-1 cities in both northern and southern India, focusing on those with prior financial experience who prefer independent decision-making. We interviewed various user categories, analyzed their responses to extract key insights, and studied the flows of direct and indirect competitors to assess their strengths and weaknesses. Based on this analysis, we created user scenarios for usability testing, assigning tasks to users to evaluate their experiences. This process aimed to identify design opportunities for improvement and enhance the overall user journey.

Painpoints discovered

Reluctance

to pledge

Users were apprehensive about taking their physical gold to the bank due to security and trust concerns.

Stigma around

gold loan

Stigma associated with gold loans, largely due to the emotional attachment people have to their gold.

Unstructured

Market

The unstructured nature of the market necessitates management through educational initiatives.

Strategy

We translated the traditional offline process of obtaining a gold loan into a digital information architecture, ensuring a seamless and intuitive user experience. Our goal was to develop a platform with industry-first capabilities that could be extended to banks, lenders, and partners beyond MPG. We also introduced a scalable solution designed to consolidate multiple financial products from various sectors into a single, cohesive platform.

Rewriting traditions

Modernizing the traditional gold loan processes

Removing stigma

Associated with gold loan & empowering users

Lending structure

To unstructured markets, bringing fairness & transparency

Design

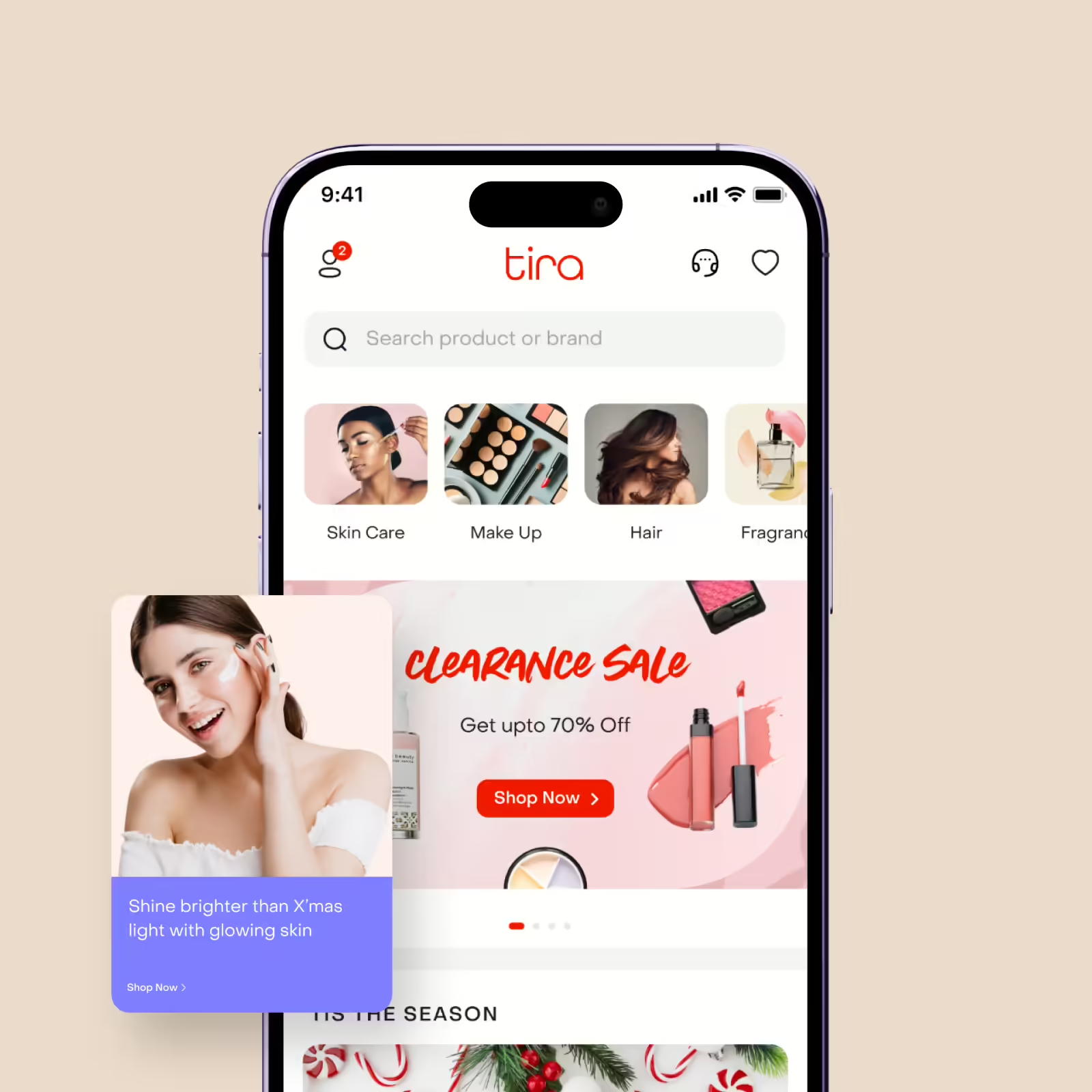

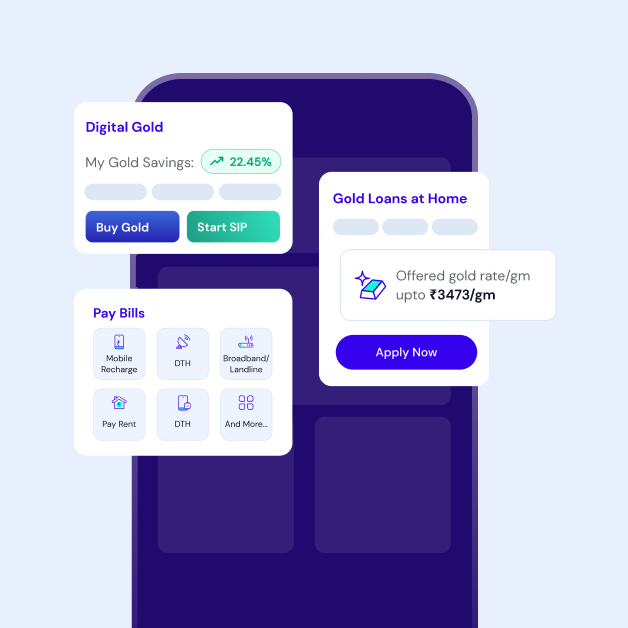

Our design aimed to empower users to invest in digital gold securely, ensuring they feel in control and informed about their investments. We created a product that offers a reliable, enhanced user experience, making digital gold a convenient part of everyday life. The design included flexible purchase options, such as one-time buys or SIP setups, and allowed users to sell or redeem their gold easily. We developed a fully functional website for a seamless, intuitive experience across all platforms. Our redesign encompassed creating

Secure Investment : Ensure users feel safe and in control of their digital gold investments.

Enhanced User Experience : Provide a reliable and intuitive interface for a seamless interaction.

Flexible Purchase Options : Offer one-time buys or SIP setups to accommodate various user preferences.

Tech-Savvy Target Audience : Focus on individuals from metro and tier-1 cities with prior financial experience and independent decision-making skills.

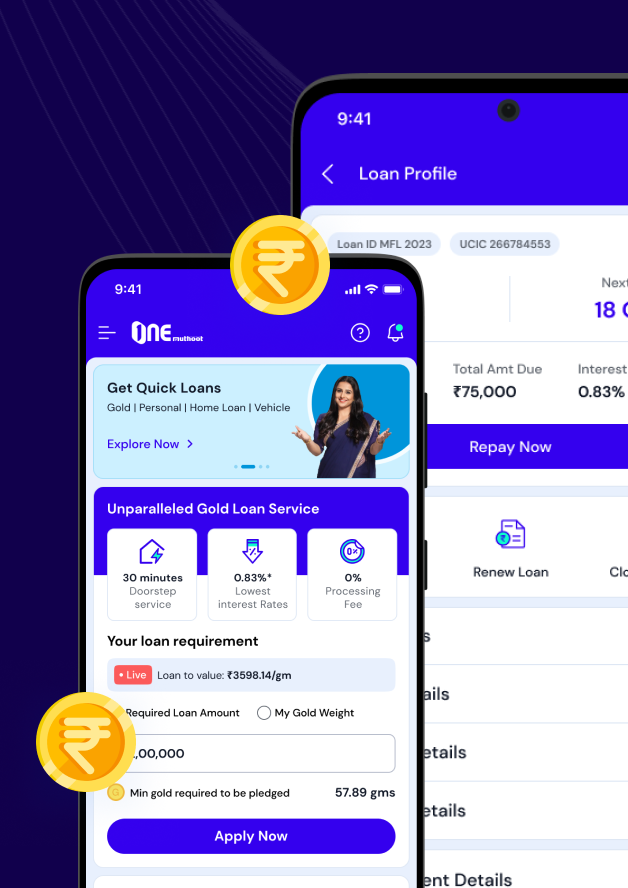

Visual design

We designed a visually engaging interface to simplify and enhance the digital gold purchase process. Users can choose between one-time purchases or set up systematic investment plans (SIPs) with ease. We also provided intuitive controls for users to sell their gold at any time or redeem it as physical gold. The design includes a fully functional website, ensuring a seamless and intuitive experience across all devices and platforms.

Outcome

After introducing a flexible, convenient, and intuitive way for users to manage their gold loans, the new app transformed their experience by integrating transparency, safety, and convenience into every step of their financial journey. Our approach involved creating a scalable structure that houses multiple product lines, ensuring easy navigation for users.

By transforming the traditional manual processes into semi-automated digital workflows, we significantly reduced the effort required in managing gold loans. This shift not only streamlined the user experience but also repositioned ONE Muthoot from being just a gold loan provider to a comprehensive, one-stop financial service platform. The platform’s architecture was designed to be scalable, accommodating a wide range of financial services under one roof, ultimately offering users a seamless and efficient way to access all their financial needs.