Domain

Finance & Fintech

Geography

India

Platform

Mobile App

Services

Research

Building trust through user research for India’s leading travel fintech.

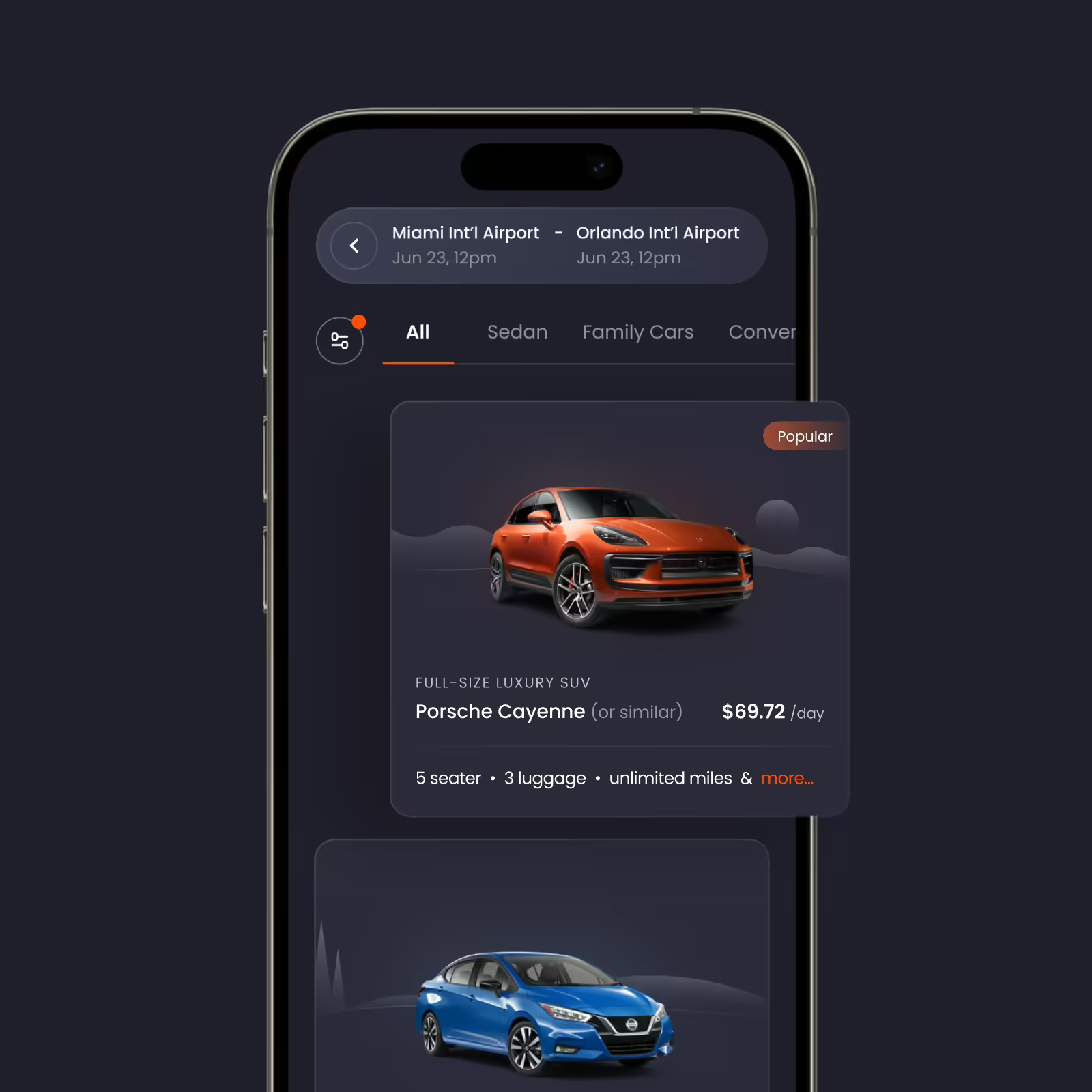

Niyo is an innovative financial technology company revolutionizing how travelers manage their finances. With a focus on delivering seamless and cost-effective forex solutions, Niyo provides digital products tailored for international travel. The company’s flagship offering, the zero-forex markup card, enables users to save on currency exchange costs while enjoying a smooth transaction experience globally. Niyo positions itself as a smart alternative to traditional financial systems, aiming to offer convenience, reliability, and transparency for modern travelers.

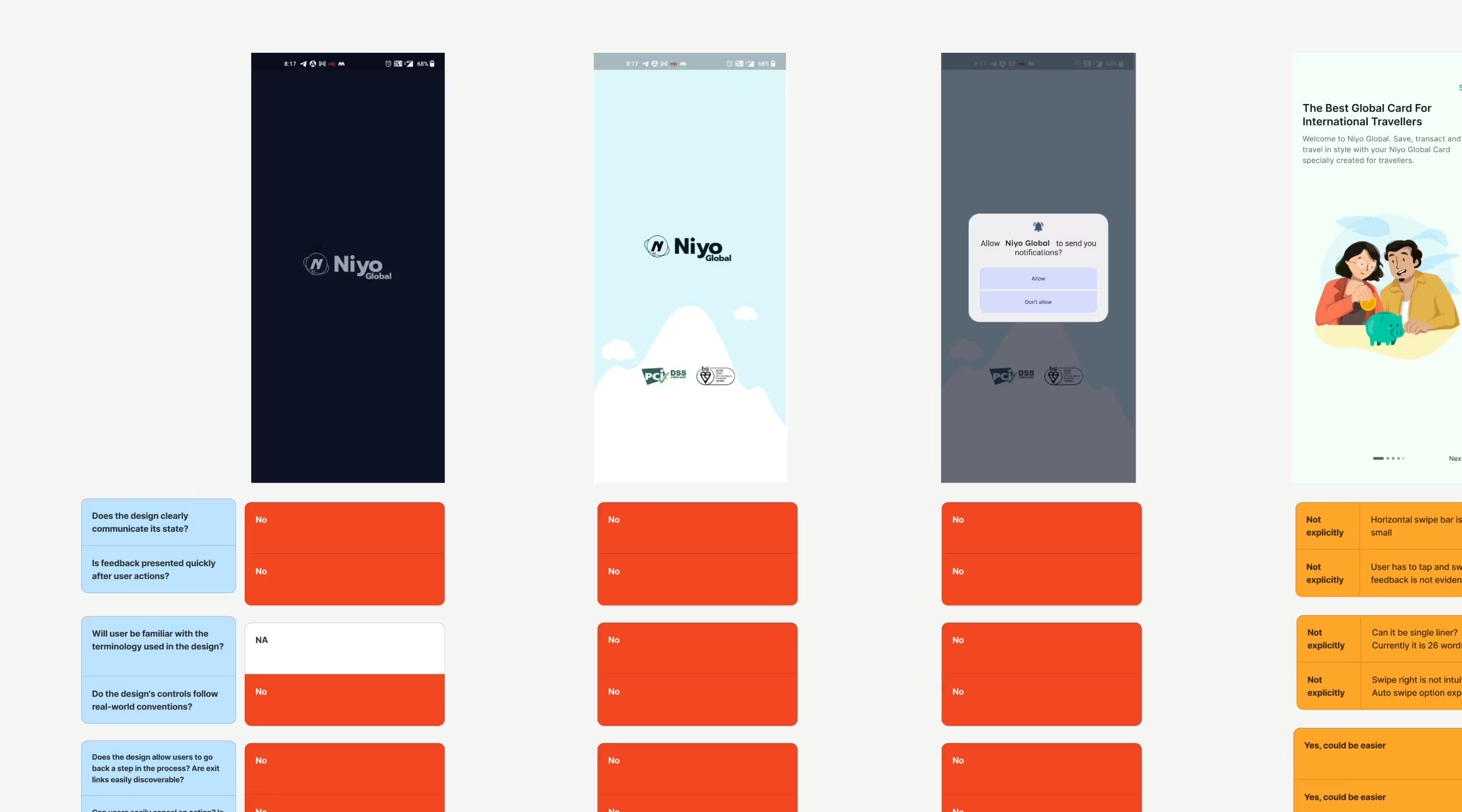

Niyo collaborated with NetBramha to tackle critical challenges hindering its growth and user adoption. Despite having a unique value proposition, Niyo faced hurdles such as low brand recognition, skepticism about its new financial products, and usability issues during onboarding. Recognizing NetBramha’s expertise in UX strategy and design thinking, Niyo sought to revamp its user experience and strengthen its competitive edge in the market.

Challenge

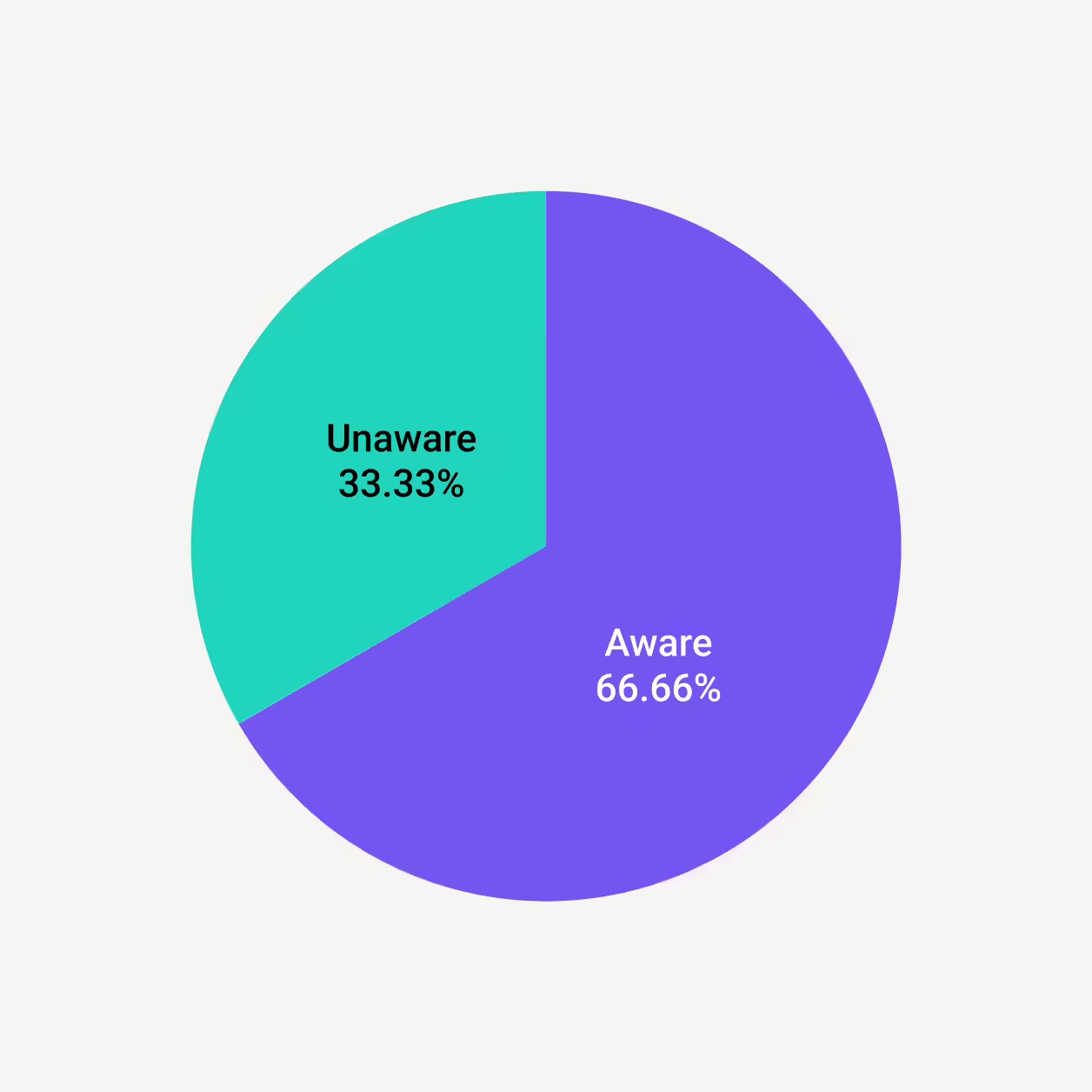

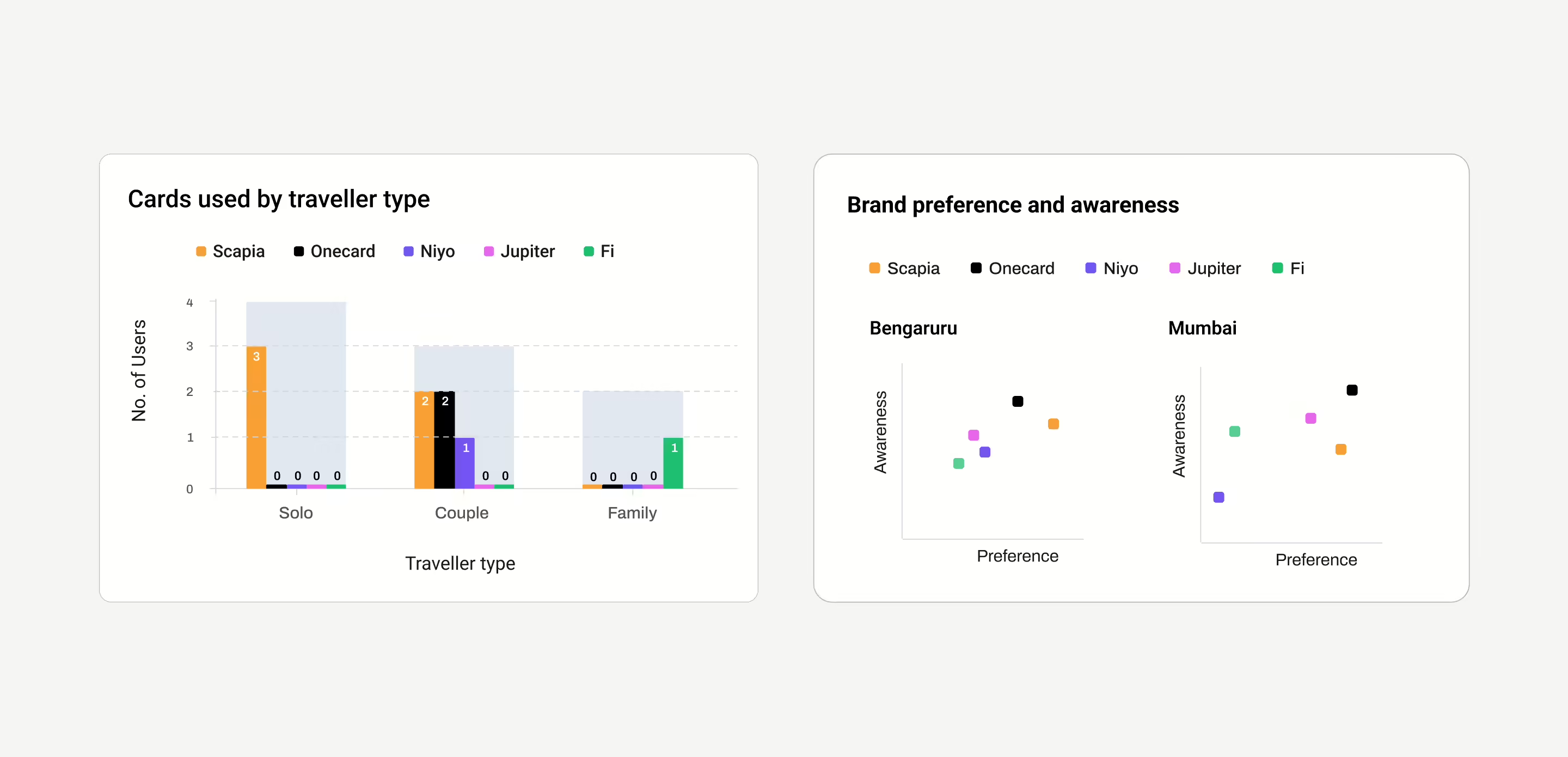

Niyo faced key challenges affecting adoption and satisfaction. With less than 25% brand awareness in markets like Mumbai, users preferred established competitors like OneCard and Scapia, perceiving Niyo as less trustworthy. Often positioned as a secondary card for forex savings or lounge access, weak branding and onboarding issues, including FD confusion and app glitches, hindered first impressions. The plain card design and basic packaging lacked premium appeal compared to competitors, while an overemphasis on zero-forex benefits overshadowed other features like cashback and travel perks, reducing its appeal as a comprehensive travel solution.

Research

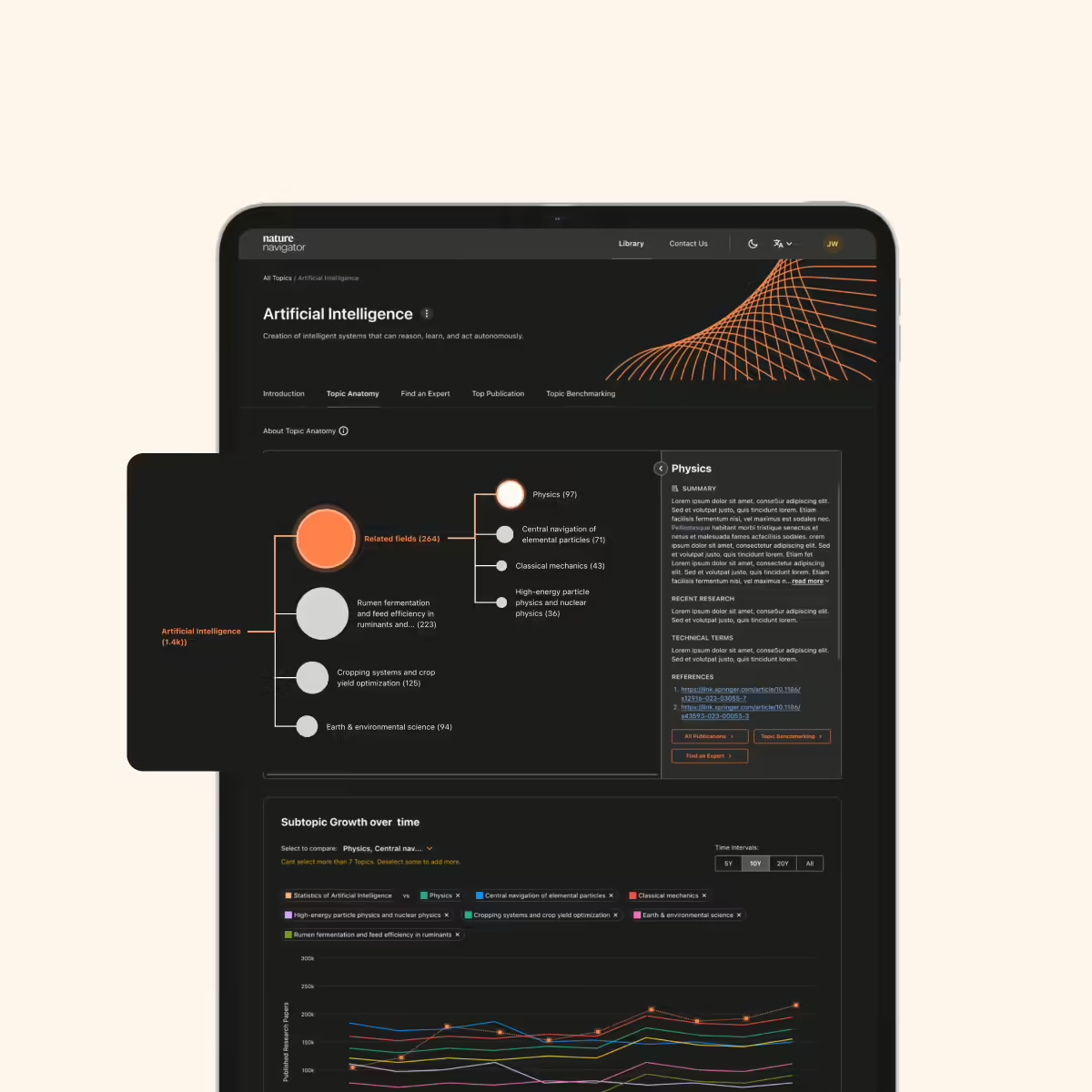

User research was crucial to uncovering the root causes of Niyo’s challenges and aligning the platform with user expectations. Through qualitative research, NetBramha sought to understand the travel planning and financial decision-making habits of Niyo’s target audience, identify usability issues in the app and onboarding process, and assess brand perception relative to competitors to pinpoint gaps. The insights aimed to provide actionable recommendations to build trust, improve user experience, and drive adoption. Without this research, Niyo risked making uninformed changes that could overlook core user needs and miss opportunities to stand out in a competitive market.

Methodology

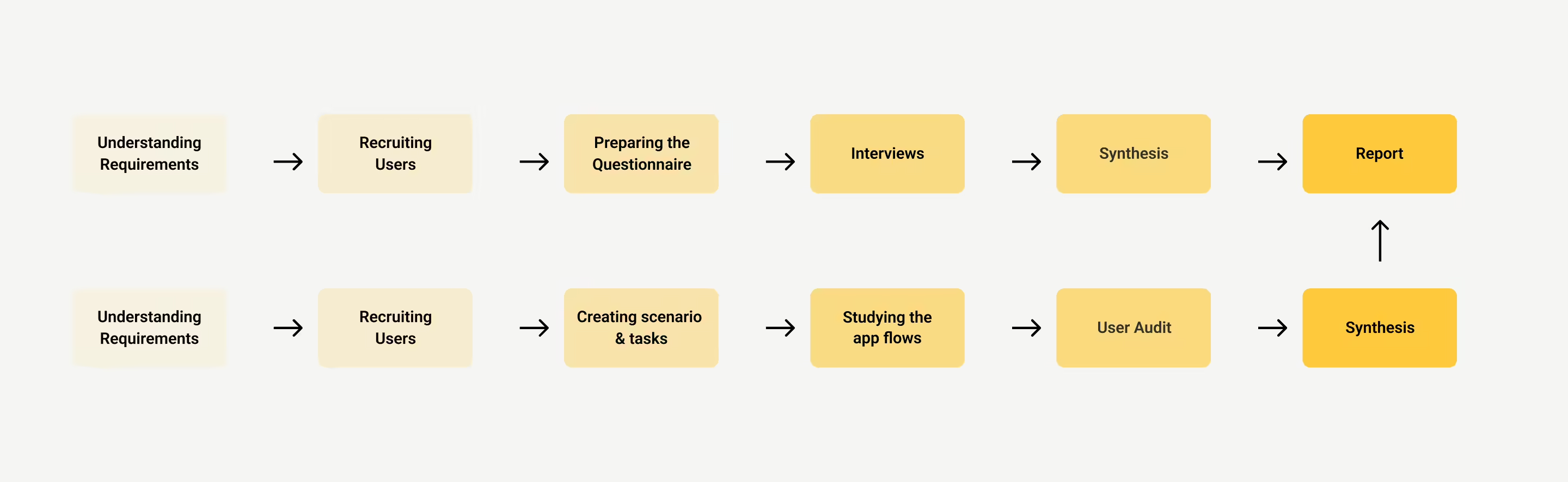

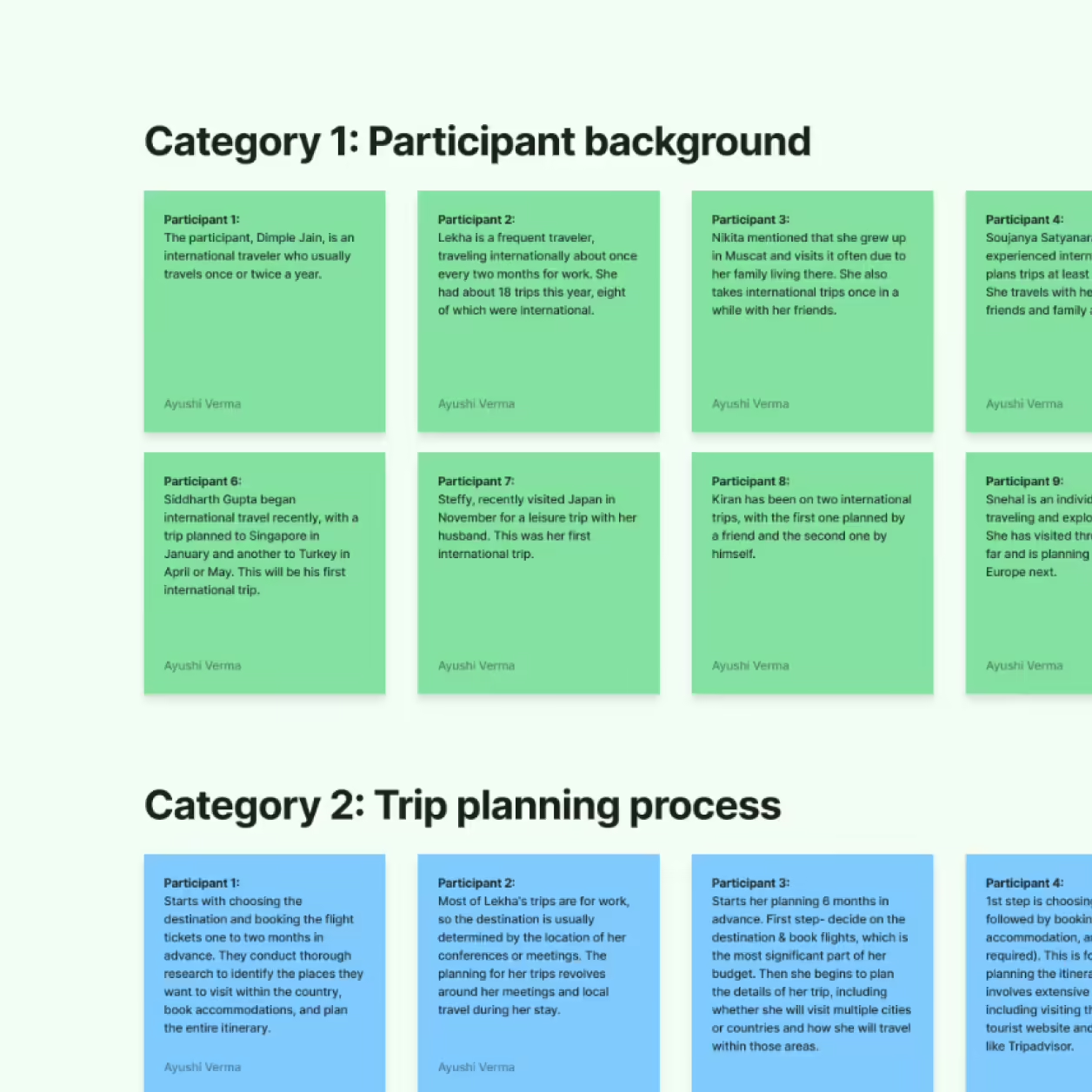

The research process was designed to capture diverse user perspectives and deliver actionable insights. A total of 34 participants from Tier 1 and Tier 2 cities, including Mumbai, Bangalore, Jaipur, and Kochi, were recruited, representing frequent and occasional travelers across various demographics and financial preferences.

Data collection involved in-depth interviews exploring travel planning, forex usage, and travel card perceptions; scenario-based tasks to evaluate app usability; and observation of behavioral patterns and emotional responses to enrich verbal feedback. Tools like Betafi were used for interviews, with data analyzed using Excel and FigJam for clarity. Competitor benchmarking allowed participants to test onboarding flows for Niyo and its rivals, revealing comparative strengths and weaknesses.

Pain points discovered

Low

Trust

Users couldn’t put trust on Niyo due to its association with unfamiliar banks and its status as a relatively new player

Onboarding

Frustrations

The FD requirement was perceived as contradictory to the “free card” promise, creating confusion

Limited Feature

Awareness

Users were unaware of features beyond zero forex, reducing perceived value., owing to non-intuitive navigation

Brand

Perception Gaps

The lack of a premium feel and effective word-of-mouth marketing led to Niyo being seen as less reliable.

Competitive

Benchmarking

The research highlighted trust as a pivotal factor in financial product adoption, revealing a significant gap for Niyo compared to competitors like Scapia and OneCard, which had already established strong credibility in the market. Niyo’s challenges stemmed from initial onboarding issues, such as confusing processes and app glitches, which eroded confidence during critical first interactions.

Furthermore, the lack of strong word-of-mouth recommendations from trusted sources like peers and family compounded this perception, making it difficult for Niyo to position itself as a reliable and preferred choice. Addressing these trust barriers became a top priority to enhance user confidence, drive adoption, and foster long-term loyalty in a highly competitive market.

Importance of Trust

Users relied heavily on positive first experiences and reviews to trust financial products

Premium Expectations

A visual, premium product offering could significantly influence user perceptions

Comprehensive solutions

Users valued a holistic solution, including convenience, security, and additional perks

Insights

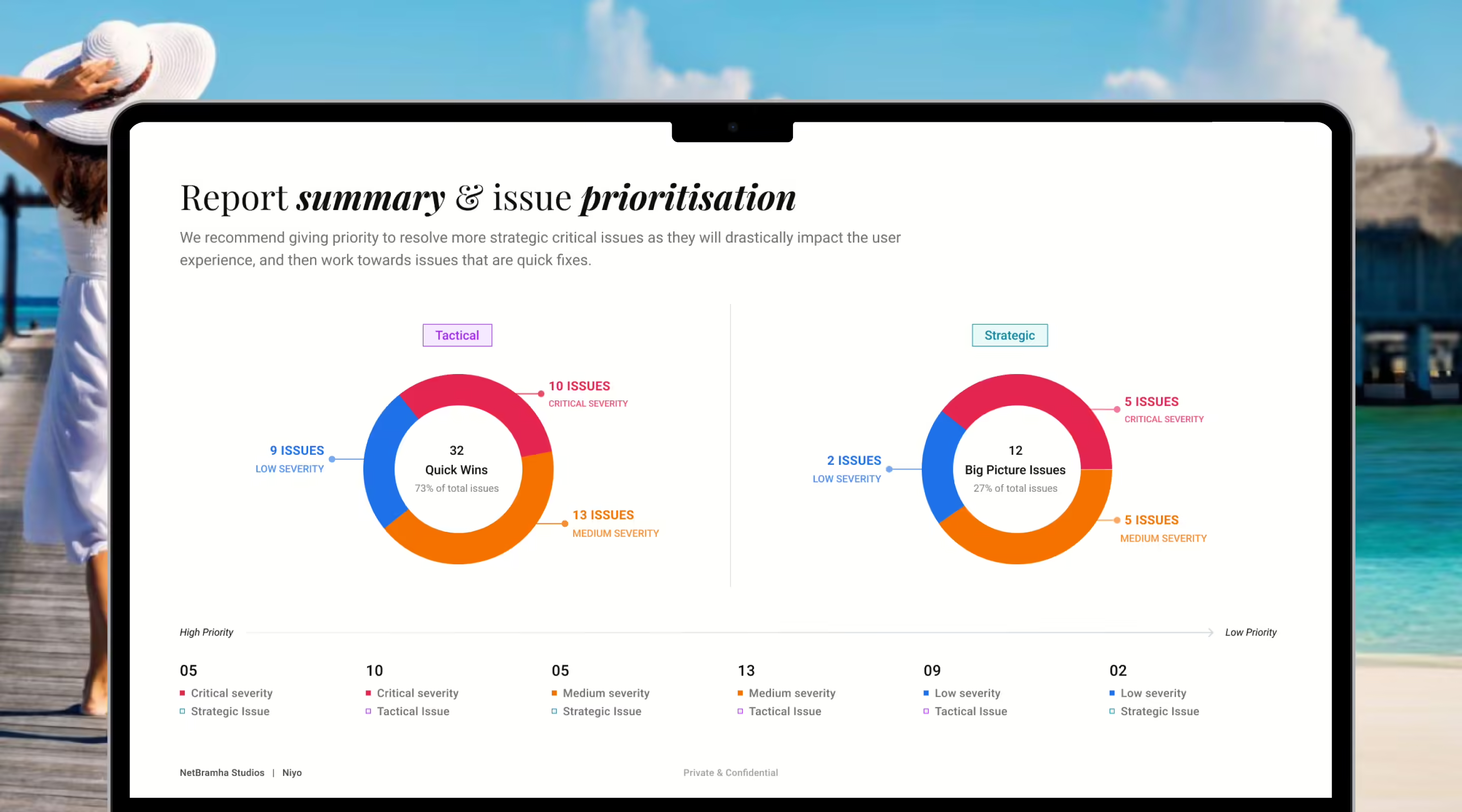

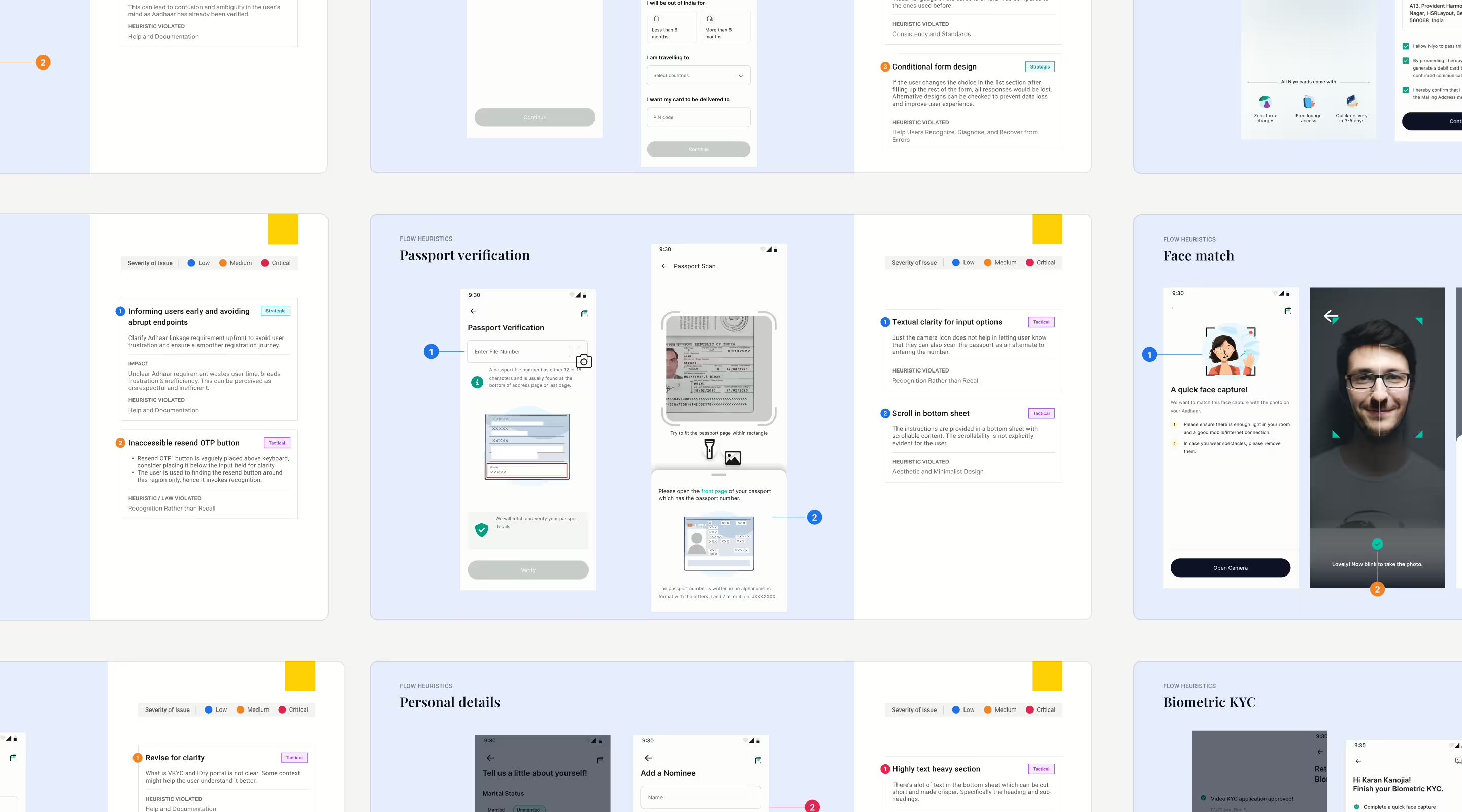

The final phase of the research brought together key insights, translating them into actionable strategies to address Niyo’s challenges and align the platform with user needs. NetBramha identified critical areas requiring intervention, including gaps in branding, limited awareness of features, and onboarding complexities.

To tackle these, the recommendations focused on:

Branding Improvements: Establishing a stronger visual identity and premium perception through design, packaging, and messaging to position Niyo as a trusted and sophisticated product.

Feature Communication: Showcasing Niyo’s full range of benefits—such as airport lounge access, cashback offers, and seamless international usage; through targeted content marketing and in-app guidance.

Onboarding Redesign: Simplifying the onboarding journey by removing ambiguities around FD requirements, streamlining steps, and ensuring a frictionless user experience.

Digital Marketing: Leveraging SEO-optimized campaigns, influencer partnerships, and travel community collaborations to boost brand visibility and organic trust-building.

Outcome

The research provided a robust foundation for Niyo’s transformation, driving key improvements across user experience, brand awareness, trust, and competitive positioning. Streamlined onboarding processes and a focus on highlighting essential features were recommended to ensure a smoother, frustration-free experience. Targeted strategies, including SEO-driven content and collaborations with travel communities, were proposed to boost recognition and credibility.

Addressing initial user skepticism and emphasizing Niyo’s unique value propositions aimed to build trust and foster long-term loyalty. Additionally, clearer messaging and a premium feel were designed to position Niyo as a leading comprehensive travel finance solution. This collaboration with NetBramha sets the stage for higher adoption rates, improved user satisfaction, and strengthened market leadership in the travel finance sector.