2025 Finance & Fintech UX Trends: Building a Global Financial Future for All

As we venture into 2025, the global fintech ecosystem is witnessing a profound transformation. Rapid technological advancements and shifting consumer behaviors are propelling financial institutions to innovate beyond borders, accessibility, inclusivity, and security for users worldwide. From AI-powered personalization to blockchain-enhanced transparency, these trends are reshaping how people manage, invest, and interact with their finances.

This blog explores the top UX trends set to define global fintech in 2025, offering deep insights, examples, and compelling statistics to showcase their impact.

1. AI-Powered Hyper-personalization: A Revolution in User-Centric Services

Artificial intelligence (AI) is enabling hyper-personalized financial services tailored to individual needs, behaviors, and even cultural contexts. By analyzing data like transaction histories, social media activity, and financial goals, fintech apps are moving beyond generic services to deliver personalized experiences.

Examples

Nubank, the largest digital bank in Latin America, uses machine learning to tailor credit card recommendations and financial advice based on local spending patterns.

Monzo in the UK provides real-time spending insights, nudging users toward better financial habits.

Why It Matters:

According to a McKinsey report, 71% of consumers expect companies to provide personalized interactions, and financial institutions that get personalization right can expect a 40% boost in revenue.

By 2025, AI-powered apps will empower users globally with proactive solutions, such as predicting cash flow issues or identifying opportunities for investments that align with their risk appetite and cultural preferences.

2. Blockchain for Enhanced Security and Transparency

Blockchain technology is setting new standards for secure, transparent, and efficient transactions. Its decentralized nature ensures that data is tamper-proof, fostering trust in financial ecosystems plagued by cyber threats.

Examples:

RippleNet facilitates cross-border payments with lower costs and faster processing, especially benefiting remittance-heavy regions like Southeast Asia and Africa.

The European Central Bank’s Digital Euro initiative is exploring blockchain to enhance payment transparency across member states.

Why It Matters:

A study by MarketsandMarkets projects the blockchain financial services market will grow to $60 billion by 2025, driven by its ability to reduce fraud and streamline operations.

For countries with high fraud rates—such as Nigeria, where online fraud rose by 174% in 2023—blockchain is a game-changer for restoring confidence in digital financial systems.

3. Voice & Gesture-Based Interfaces: Making Fintech Accessible

Voice and gesture interfaces are breaking barriers in fintech by making services more accessible to underserved populations, including those with disabilities and low digital literacy.

Examples:

M-Pesa in Kenya is piloting voice-command-based transactions to expand access in rural areas where literacy rates are lower.

In Japan, Sony Bank leverages gesture recognition for ATM interactions, reducing reliance on traditional PIN systems.

Why It Matters:

Globally, an estimated 2.2 billion people experience visual or physical impairments (WHO, 2022). Voice and gesture-based technologies ensure financial inclusivity for this demographic while offering convenience for tech-savvy users seeking hands-free interactions.

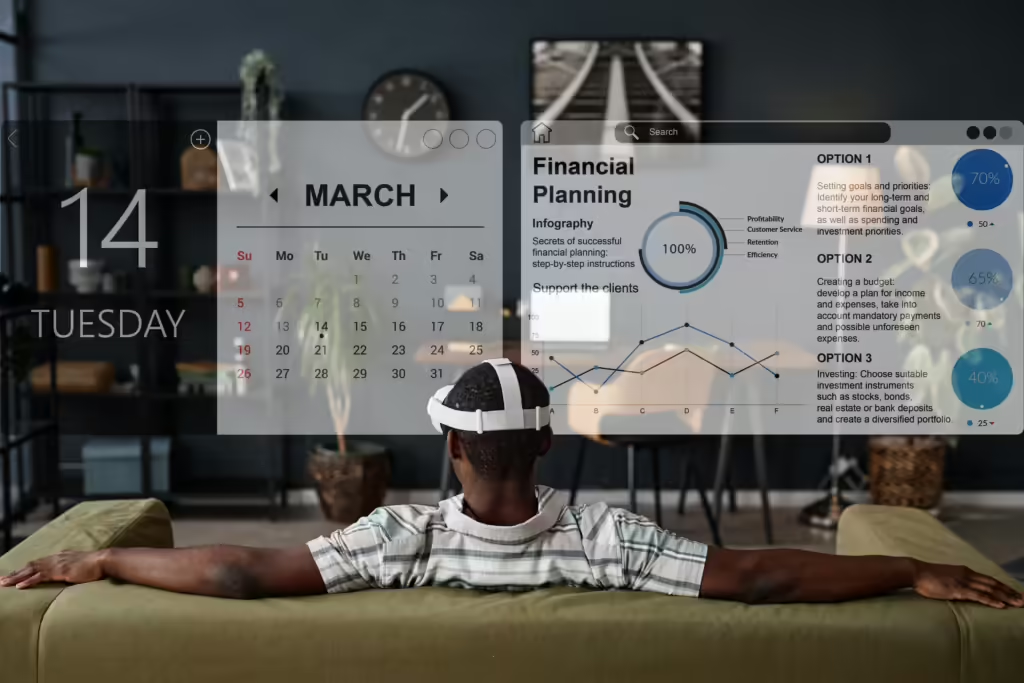

4. Augmented Reality (AR) for Financial Literacy

AR technology is revolutionizing financial education by making abstract concepts tangible and engaging. This is particularly critical in regions where financial literacy rates are low.

Examples:

Bank of America’s Better Money Habits AR app allows users to visualize the impact of their spending decisions in real time.

In India, HDFC Bank has piloted AR tools to educate customers about mutual fund investments through interactive visualizations.

Why It Matters:

Financial literacy directly correlates with economic empowerment. A S&P survey revealed that 33% of adults worldwide are financially illiterate. AR tools can bridge this gap by making complex topics—like compound interest or portfolio diversification—easy to understand.

5. Embedded Finance: Simplifying Financial Ecosystems

Embedded finance integrates banking services directly into non-financial platforms, offering users seamless experiences. From e-commerce to ride-sharing, this trend eliminates the need for users to juggle multiple apps.

Examples:

Grab in Southeast Asia provides microloans and insurance directly through its ride-hailing app.

In Latin America, MercadoLibre embeds payment solutions and lending services within its e-commerce platform, enabling small businesses to thrive.

Why It Matters:

Embedded finance is projected to be a $7 trillion market by 2030 (Lightyear Capital). For regions with limited banking infrastructure, like sub-Saharan Africa, embedding financial tools in everyday platforms significantly expands access.

6. RegTech for Compliance: Streamlining Global Regulations

Regulatory technology (RegTech) is automating compliance processes, helping financial institutions navigate diverse regulatory landscapes with precision. By 2025, RegTech will be integral to fintech trends, leveraging AI and blockchain to streamline compliance, reduce costs, and enhance transparency. It will empower financial institutions to adapt swiftly to evolving regulations while ensuring robust risk management and operational efficiency.

Examples:

ComplyAdvantage uses AI to monitor global AML and KYC regulations, catering to fintechs operating in multiple jurisdictions.

In Australia, First AML automates compliance processes for small businesses, saving hours of manual work.

Why It Matters:

With the cost of non-compliance reaching $14 billion annually (Thomson Reuters, 2023), RegTech ensures financial institutions can adapt to changing laws while focusing on innovation.

7. Super Apps: The Future of Consolidated Financial Services

Super apps, which combine multiple functionalities into a single interface, are redefining convenience and accessibility. Popularized in Asia, they’re now expanding globally, catering to diverse financial needs.

Examples:

Alipay in China remains a leader, offering banking, investing, and lifestyle services in one app.

In Europe, Revolut is replicating the super app model, integrating travel booking, cryptocurrency trading, and budgeting tools.

Why It Matters:

Super apps simplify financial management, especially in developing markets where internet and device access may be limited. By 2025, they’re expected to serve over 2 billion users worldwide.

8. Sustainability-Focused Features: Aligning Finance with Values

Sustainability is becoming a core focus in fintech, with apps helping users track their carbon footprint, invest in green funds, and adopt eco-friendly financial habits.

Examples:

Aspiration in the US plants trees for every transaction, enabling users to align spending with environmental goals.

In Scandinavia, Doconomy offers a carbon calculator linked to credit card purchases, empowering users to offset their impact.

Why It Matters:

A Nielsen study showed that 73% of global consumers prefer brands with sustainability commitments. Fintech platforms that integrate eco-friendly features are not only enhancing user experiences but also driving environmental impact.

Conclusion: A Unified Vision for Fintech in 2025

The fintech industry in 2025 transcends borders, catering to diverse cultures, economies, and user expectations. Whether through hyper-personalized AI solutions, blockchain-enhanced security, or AR-powered education, these trends promise to make financial services more inclusive, secure, and sustainable.

For businesses, staying ahead of these trends isn’t just about maintaining a competitive edge—it’s about shaping the financial future for a global audience. As we move forward, fintech’s role in bridging economic disparities and fostering innovation will be pivotal in creating a more connected and equitable world.